Asked by Tyler Bergh on Apr 26, 2024

Verified

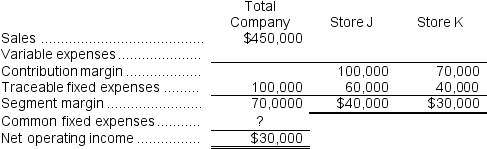

Ieso Corporation's total fixed expenses for the year were:

A) $40,000

B) $100,000

C) $140,000

D) $170,000

Fixed Expenses

Costs that do not change with the level of production or sales activities, such as rent, salaries, and insurance.

- Understand the significance of fixed and variable expenses in cost-volume-profit analysis.

Verified Answer

FM

Fernanda MorenoApr 30, 2024

Final Answer :

C

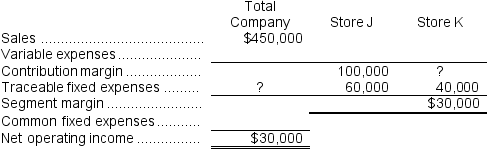

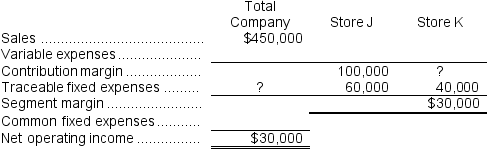

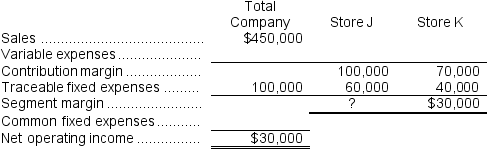

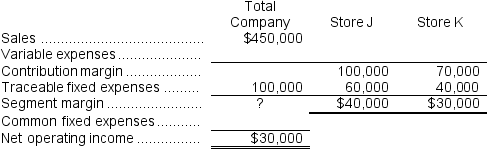

Explanation :  Store K segment margin = Store K contribution margin - Store K traceable fixed expenses

Store K segment margin = Store K contribution margin - Store K traceable fixed expenses

$30,000 = Store K contribution margin - $40,000

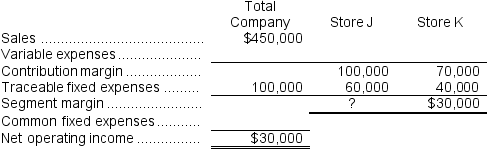

Store K contribution margin = $30,000 + $40,000 = $70,000

Total traceable fixed expenses = $60,000 + $40,000 = $100,000 Store J segment margin = $100,000 - $60,000 = $40,000

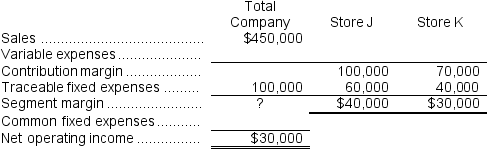

Store J segment margin = $100,000 - $60,000 = $40,000  Total segment margin = $40,000 + $30,000 = $70,000

Total segment margin = $40,000 + $30,000 = $70,000  Net operating income = Total segment margin - Common fixed expenses

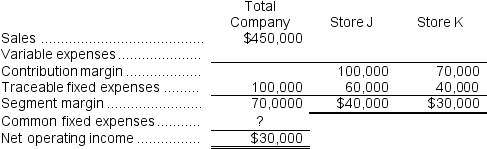

Net operating income = Total segment margin - Common fixed expenses

$30,000 = $70,000 - Common fixed expenses

Common fixed expenses = $70,000 - $30,000 = $40,000

Total fixed expenses = Total traceable fixed expenses + Common fixed expenses

= $100,000 + $40,000 = $140,000

Reference: CHO7-Ref43

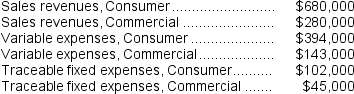

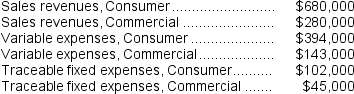

Ferrar Corporation has two major business segments: Consumer and Commercial.Data for the segments and for the company for March appear below: In addition, common fixed expenses totaled $210,000 and were allocated as follows: $122,000 to the Consumer business segment and $88,000 to the Commercial business segment.

In addition, common fixed expenses totaled $210,000 and were allocated as follows: $122,000 to the Consumer business segment and $88,000 to the Commercial business segment.

Store K segment margin = Store K contribution margin - Store K traceable fixed expenses

Store K segment margin = Store K contribution margin - Store K traceable fixed expenses$30,000 = Store K contribution margin - $40,000

Store K contribution margin = $30,000 + $40,000 = $70,000

Total traceable fixed expenses = $60,000 + $40,000 = $100,000

Store J segment margin = $100,000 - $60,000 = $40,000

Store J segment margin = $100,000 - $60,000 = $40,000  Total segment margin = $40,000 + $30,000 = $70,000

Total segment margin = $40,000 + $30,000 = $70,000  Net operating income = Total segment margin - Common fixed expenses

Net operating income = Total segment margin - Common fixed expenses$30,000 = $70,000 - Common fixed expenses

Common fixed expenses = $70,000 - $30,000 = $40,000

Total fixed expenses = Total traceable fixed expenses + Common fixed expenses

= $100,000 + $40,000 = $140,000

Reference: CHO7-Ref43

Ferrar Corporation has two major business segments: Consumer and Commercial.Data for the segments and for the company for March appear below:

In addition, common fixed expenses totaled $210,000 and were allocated as follows: $122,000 to the Consumer business segment and $88,000 to the Commercial business segment.

In addition, common fixed expenses totaled $210,000 and were allocated as follows: $122,000 to the Consumer business segment and $88,000 to the Commercial business segment.

Learning Objectives

- Understand the significance of fixed and variable expenses in cost-volume-profit analysis.