Asked by Mallika Khullar on May 31, 2024

Verified

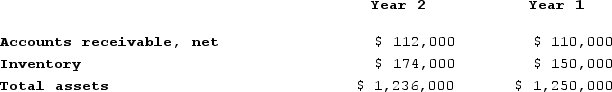

Guttery Corporation has provided the following financial data from its balance sheet:  Sales on account in Year 2 totaled $1,450,000 and cost of goods sold totaled $900,000.The company's average collection period for Year 2 is closest to: (Round your intermediate calculations to 2 decimal places.)

Sales on account in Year 2 totaled $1,450,000 and cost of goods sold totaled $900,000.The company's average collection period for Year 2 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) 1.1 days

B) 28.2 days

C) 1.0 days

D) 27.9 days

Average Collection Period

The typical duration a business must wait to collect payments from its customers for goods or services sold on a credit basis.

Financial Data

Refers to information related to the financial performance of an entity, including income, expenses, assets, and liabilities.

Sales On Account

Transactions where goods or services are sold and payment is deferred to a future date, essentially selling on credit.

- Comprehend the method for calculating the average sale and collection durations.

Verified Answer

ZK

Zybrea KnightJun 05, 2024

Final Answer :

D

Explanation :

The average collection period can be calculated as:

Accounts Receivable Turnover Ratio = Credit Sales / Average Accounts Receivable

Average Collection Period = 365 / Accounts Receivable Turnover Ratio

First, we need to calculate the accounts receivable turnover ratio:

Accounts Receivable Turnover Ratio = Credit Sales / Average Accounts Receivable

Credit Sales = $1,450,000

Cost of goods sold = $900,000

Thus, the gross profit = $1,450,000 - $900,000 = $550,000

Gross profit margin = Gross profit / Sales

Gross profit margin = $550,000 / $1,450,000 = 0.3793

Now, we can use the gross profit margin to estimate the average accounts receivable for the year:

Average Accounts Receivable = Gross profit margin x Annual Sales / 365

Average Accounts Receivable = 0.3793 x $1,450,000 / 365 = $1,510.36

Accounts Receivable Turnover Ratio = Credit Sales / Average Accounts Receivable

Accounts Receivable Turnover Ratio = $1,450,000 / $1,510.36 = 0.9603

Average Collection Period = 365 / Accounts Receivable Turnover Ratio

Average Collection Period = 365 / 0.9603 = 379.99 days

Therefore, the average collection period for Year 2 is closest to 27.9 days (rounded to the nearest tenth). The correct answer is D.

Accounts Receivable Turnover Ratio = Credit Sales / Average Accounts Receivable

Average Collection Period = 365 / Accounts Receivable Turnover Ratio

First, we need to calculate the accounts receivable turnover ratio:

Accounts Receivable Turnover Ratio = Credit Sales / Average Accounts Receivable

Credit Sales = $1,450,000

Cost of goods sold = $900,000

Thus, the gross profit = $1,450,000 - $900,000 = $550,000

Gross profit margin = Gross profit / Sales

Gross profit margin = $550,000 / $1,450,000 = 0.3793

Now, we can use the gross profit margin to estimate the average accounts receivable for the year:

Average Accounts Receivable = Gross profit margin x Annual Sales / 365

Average Accounts Receivable = 0.3793 x $1,450,000 / 365 = $1,510.36

Accounts Receivable Turnover Ratio = Credit Sales / Average Accounts Receivable

Accounts Receivable Turnover Ratio = $1,450,000 / $1,510.36 = 0.9603

Average Collection Period = 365 / Accounts Receivable Turnover Ratio

Average Collection Period = 365 / 0.9603 = 379.99 days

Therefore, the average collection period for Year 2 is closest to 27.9 days (rounded to the nearest tenth). The correct answer is D.

Learning Objectives

- Comprehend the method for calculating the average sale and collection durations.