Asked by sanyam chawla on May 04, 2024

Verified

Grayson Company is considering two new projects each requiring an equipment investment of $72000. Each project will last for three years and produce the following annual net income.

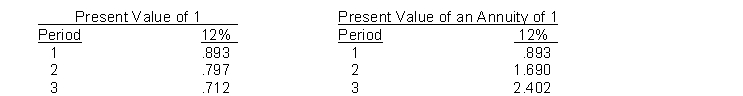

Year TIP TOP 1$8,000$9,00029,0009,000314,0009,000\begin{array} { c r r } \text { Year } & { \text { TIP } } & { \text { TOP } } \\1 & \$ 8,000 & \$ 9,000 \\2 & 9,000 & 9,000 \\3 & 14,000 & 9,000\end{array} Year 123 TIP $8,0009,00014,000 TOP $9,0009,0009,000 The equipment will have no salvage value at the end of its three-year life. Grayson Company uses straight-line depreciation. Grayson requires a minimum rate of return of 12%. Present value data are as follows:  Instructions

Instructions

(a) Compute the net present value of each project.

(b) Which project should be selected? Why?

Straight-Line Depreciation

An approach to apportion the cost of a tangible asset throughout its operational life in equal yearly sums.

Net Present Value

A financial calculation used to determine the value of a series of future cash flows by discounting them back to their value in today's dollars.

Required Rate Of Return

The minimum annual percentage earned by an investment that will induce individuals or companies to put their money into a particular security or project.

- Familiarize oneself with the key notions and approaches of capital budgeting, including net present value, internal rate of return, and payback period.

- Assess the practicability of projects by applying different capital budgeting techniques.

Verified Answer

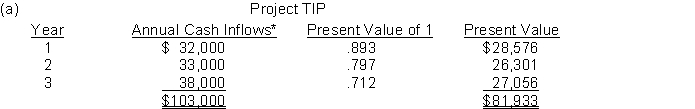

*Net income plus annual depreciation of $24000. Present value of future cash inflows $81,933 Capital investment 72,000‾ Positive net present value $.933‾\begin{array}{lr}\text { Present value of future cash inflows } & \$ 81,933 \\\text { Capital investment } & \underline{72,000} \\\text { Positive net present value } & \underline{\$ .933} \\\end{array} Present value of future cash inflows Capital investment Positive net present value $81,93372,000$.933

*Net income plus annual depreciation of $24000. Present value of future cash inflows $81,933 Capital investment 72,000‾ Positive net present value $.933‾\begin{array}{lr}\text { Present value of future cash inflows } & \$ 81,933 \\\text { Capital investment } & \underline{72,000} \\\text { Positive net present value } & \underline{\$ .933} \\\end{array} Present value of future cash inflows Capital investment Positive net present value $81,93372,000$.933 \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad \quad Project TOP \text { Project TOP } Project TOP

Present value of future cash inflows ($33,000×2.402)$79,266 Capital investment 72,000 Positive net present value $7,266\begin{array}{ll} \text { Present value of future cash inflows \((\$ 33,000 \times 2.402)\)}&\$79,266 \\\text { Capital investment } &72,000\\\text { Positive net present value }&\$7,266\end{array} Present value of future cash inflows ($33,000×2.402) Capital investment Positive net present value $79,26672,000$7,266 (b) Both projects are acceptable because both show a positive net present value. Project TIP is the preferred project because its positive net present value is greater than project TOP's net present value.

Learning Objectives

- Familiarize oneself with the key notions and approaches of capital budgeting, including net present value, internal rate of return, and payback period.

- Assess the practicability of projects by applying different capital budgeting techniques.

Related questions

In Using the Net Present Value Approach a Project Is ...

Mc Gee Corporation Recently Purchased a New Machine for Its ...

Niro Company Has Money Available for Investment and Is Considering ...

A Capital Budgeting Technique Which Takes into Consideration the Time ...

If the Straight-Line Depreciation Method Is Used, the Annual Average ...