Asked by Changhao Zhang on Jul 05, 2024

Verified

Grand Company issued $150,000 of 5-year bonds on January 1,2019 with a coupon interest rate of 14%,payable annually each December 31.On January 1,2019,the market interest rate was 12%.Assume effective-interest amortization.(The present value factor for $1 at 6% for 10 periods is 0.55839,for $1 at 7% for 10 periods is 0.50835,for $1 at 14% for 5 periods is 0.51937,and for $1 at 12% for 5 periods is 0.56743.The present value of an annuity of $1 for 10 periods at 6% is 7.36009,for 10 periods at 7% is 7.02358,for 5 periods at 6% is 4.21236,for 5 periods at 7% is 4.10020,and for 5 periods at 12% is 3.60478).Round your final answers to the nearest next whole dollar amount.

A.Calculate the issue price (total amount received)at January 1,2019.

B.What would be the amount of premium amortization for December 31,2019? No adjusting journal entries have been made during the year.

C.What would be the amount of the interest payment on December 31,2019?

D.What is the book value of the bonds at December 31,2019?

Effective-Interest Amortization

A method of amortizing a bond discount or bond premium that reflects the effective interest rate a company pays bondholders over the life of a bond.

Coupon Interest Rate

The annual interest rate paid by a bond expressed as a percentage of its face value.

Present Value Factor

A factor used to calculate the present value of a sum to be received in the future, considering a specific interest rate over a certain period.

- Understand the basic principles of bond issuance, including determining the issue price and the influence of market rates on it.

- Investigate the consequences of bond premium and discount, including the process of their amortization over the bond's lifespan using diverse methodologies.

- Construct ledger entries for bond-related activities, including their launch, interest disbursements, and conclusion.

Verified Answer

ZK

Zybrea KnightJul 06, 2024

Final Answer :

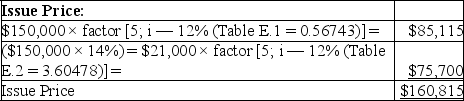

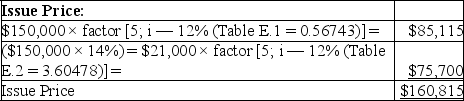

A.$160,815.

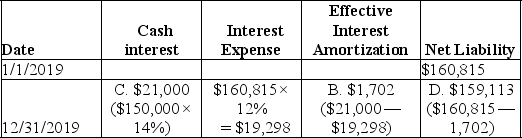

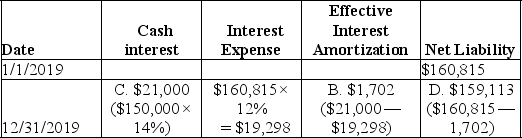

B.$1,702.

C.$21,000.

D.$159,113

A.

Amortization Schedule

Amortization Schedule

B.$1,702.

C.$21,000.

D.$159,113

A.

Amortization Schedule

Amortization Schedule

Learning Objectives

- Understand the basic principles of bond issuance, including determining the issue price and the influence of market rates on it.

- Investigate the consequences of bond premium and discount, including the process of their amortization over the bond's lifespan using diverse methodologies.

- Construct ledger entries for bond-related activities, including their launch, interest disbursements, and conclusion.