Asked by Aveyan Walker on Jul 15, 2024

Verified

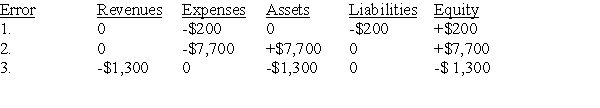

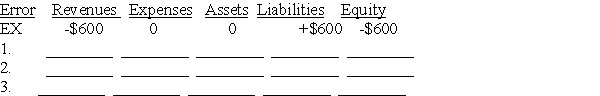

Given the table below,indicate the impact of the following errors made during the adjusting entry process.Use a "+" followed by the amount for overstatements,a "-" followed by the amount for understatements,and a "0" for no effect.The first one is done as an example.

Ex.Failed to recognize that $600 of unearned revenues,previously recorded as liabilities,had been earned by year-end.

1.Failed to accrue interest expense of $200.

2.Forgot to record $7,700 of depreciation on machinery.

3.Failed to accrue $1,300 of revenue earned but not collected.

Unearned Revenues

Money received by a company for goods or services yet to be delivered or performed, considered a liability until fulfilled.

Depreciation

The systematic allocation of the cost of a tangible asset over its useful life, reflecting the loss of value due to age, wear, and tear, or obsolescence.

Accrue Interest

The process of recognizing interest earned or incurred on an outstanding debt over a period of time.

- Gain insight into the inaccuracies arising during the adjustment entry process and their effects.

Verified Answer

Learning Objectives

- Gain insight into the inaccuracies arising during the adjustment entry process and their effects.

Related questions

Using the Table Below,indicate the Impact of the Following Errors ...

Indicate Whether the Following Error Would Cause the Adjusted Trial ...

Indicate Whether the Following Error Would Cause the Adjusted Trial ...

If the Adjustment to Recognize Expired Insurance at the End ...

A Company Receives $6,500 for Two Season Tickets Sold on ...