Asked by Lisbeth Molina on May 13, 2024

Verified

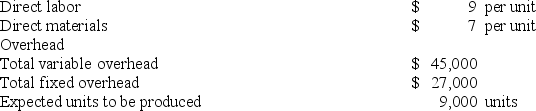

Given the following data,total product cost per unit under absorption costing will be greater than total product cost per unit under variable costing.

Absorption Costing

Absorption costing is an accounting method where all of the manufacturing costs, including both fixed and variable costs, are allocated to produced units, thus encompassing direct materials, direct labor, and overheads.

Variable Costing

An accounting method that only includes variable production costs (direct labor, direct materials, and variable manufacturing overhead) in product costs, excluding fixed overhead.

Product Cost

Product cost refers to the total expenses incurred to create a product, including direct labor, materials, and allocated overhead.

- Acquire knowledge about the essential aspects of absorption costing and the method by which it accounts for the total cost of production.

- Identify the distinctions between absorption and variable costing, focusing on how they report income and manage costs differently.

Verified Answer

Learning Objectives

- Acquire knowledge about the essential aspects of absorption costing and the method by which it accounts for the total cost of production.

- Identify the distinctions between absorption and variable costing, focusing on how they report income and manage costs differently.

Related questions

Absorption Costing Is Useful Because It Reflects the Full Costs ...

Under Variable Costing,product Costs Consist of Direct Labor,direct Materials,and Variable ...

Assuming Fixed Costs Remain Constant,and a Company Sells More Units ...

When the Number of Units Produced Is Equal to the ...

Under Variable Costing,product Costs Consist of Direct Labor,direct Materials,and Fixed ...