Asked by Chance Walker on Jul 24, 2024

Verified

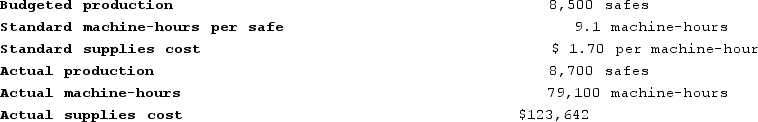

Geschke Corporation, which produces commercial safes, has provided the following data:  Supplies cost is an element of variable manufacturing overhead.The variable overhead efficiency variance for supplies is closest to:

Supplies cost is an element of variable manufacturing overhead.The variable overhead efficiency variance for supplies is closest to:

A) $10,947 Favorable

B) $119 Unfavorable

C) $10,947 Unfavorable

D) $119 Favorable

Supplies Cost

The expense associated with acquiring supplies necessary for the operation of a business, such as office supplies or manufacturing inputs.

Variable Overhead Efficiency Variance

The difference between the standard cost of variable overheads allocated for production and the actual cost incurred.

Variable Manufacturing Overhead

Indirect manufacturing costs that change in total in direct proportion to changes in production volume, such as utilities or materials.

- Gain insight into the process of figuring variable overhead efficiency variances.

Verified Answer

If the variance is favorable, it means that the actual quantity of supplies used was less than the standard quantity, or that the actual price per unit was lower than the standard price. Therefore, the cost of supplies would be lower than expected, which is good for the company.

If the variance is unfavorable, it means that the actual quantity of supplies used was higher than the standard quantity, or that the actual price per unit was higher than the standard price. Therefore, the cost of supplies would be higher than expected, which is bad for the company.

Based on this reasoning, we can eliminate choices A and C, since they both suggest a large unfavorable variance, which would not be good for the company.

Now we are left with choices B and D. If the variance is only $119, it means that it is relatively small compared to the total cost of supplies. Therefore, we can assume that it is more likely to be favorable than unfavorable, since a small difference in quantity or price would not have a significant impact on the cost.

Therefore, the best choice is D, with a favorable variance of $119.

Learning Objectives

- Gain insight into the process of figuring variable overhead efficiency variances.

Related questions

Valera Corporation Makes a Product with the Following Standards for ...

The Maxit Corporation Has a Standard Costing System in Which ...

Brummer Corporation Makes a Product Whose Variable Overhead Standards Are ...

The Maxit Corporation Has a Standard Costing System in Which ...

The Variable Overhead Efficiency Variance for July Is ...