Asked by Dallas Thompson on Jul 21, 2024

Verified

George wants to borrow $30,000 to purchase a car.After looking at a monthly budget he realizes that all he can afford to pay per month is $350.The dealership is offering a 4.77% loan.When George hears how much interest he will pay over the life of the loan,he decides to cut back on his entertainment expenses and pay $400 per month.How much in interest will George save by paying an extra $50 per month? Hint: Round any loan length calculations to the nearest quarter of a year.

Entertainment Expenses

Costs incurred for activities that provide amusement or enjoyment, often scrutinized for tax deduction purposes.

Loan Length Calculations

The process of determining the duration over which a borrower must repay their loan, factoring in the loan amount, interest rate, and repayment amount.

Monthly Budget

A financial plan that estimates income and sets limits on expenditures for a month.

- Understand the impact of different payment amounts on the total interest paid over the life of a loan.

- Utilize mathematical capabilities to determine the term of a loan using monthly installments and interest rates.

Verified Answer

KS

Kiomary SotilloJul 24, 2024

Final Answer :

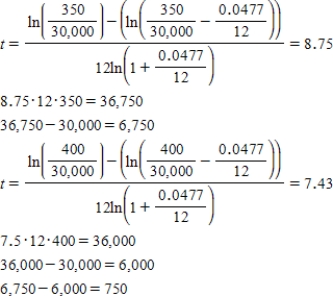

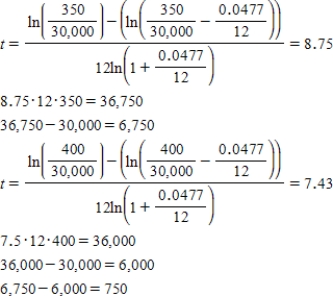

Find the length of the loan with a $350 payment.Multiply the monthly payment by the length of the loan in months and subtract the purchase price from the total payment amount.Do the same for the loan with a $400 payment and subtract the two results.

Learning Objectives

- Understand the impact of different payment amounts on the total interest paid over the life of a loan.

- Utilize mathematical capabilities to determine the term of a loan using monthly installments and interest rates.