Asked by Anika Singh on May 28, 2024

Verified

Galena Pharmacy reported cost of goods sold as follows: 2016‾2017‾Beginning inventory54,000$64,000Cost of goods purchased847,000‾891,000‾Cost of goods available for sale901,000955,000Ending inventory64,000‾55,000‾Cost of goods sold$837,000‾$900,000‾\begin{array}{lcc}& \underline{2016}& \underline{2017}\\\text {Beginning inventory}&54,000 & \$ 64,000 \\\text {Cost of goods purchased}& \underline{847,000} & \underline{891,000} \\\text {Cost of goods available for sale}&901,000 & 955, 000 \\\text {Ending inventory}& \underline{ 64,000} & \underline{55,000 }\\\text {Cost of goods sold}& \underline{ \$ 837,000} & \underline{ \$ 900,000}\end{array}Beginning inventoryCost of goods purchasedCost of goods available for saleEnding inventoryCost of goods sold201654,000847,000901,00064,000$837,0002017$64,000891,000955,00055,000$900,000

Jim Holt the bookkeeper made two errors:

(1) 2016 ending inventory was overstated by $7000.

(2) 2017 ending inventory was understated by $16000.

Instructions

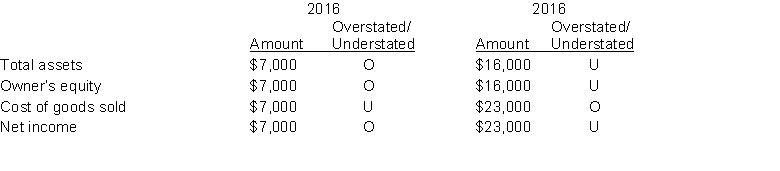

Assuming the errors had not been corrected indicate the dollar effect that the errors had on the items appearing on the financial statements listed below. Also indicate if the amounts are overstated (O) or understated (U). 11eb1392_1bf1_b3a7_8021_79c4e89749fb

Cost of Goods Sold

The immediate expenses related to manufacturing goods for sale in a business, which encompass both materials and labor costs.

Beginning Inventory

The value of a company's inventory at the start of an accounting period, used to calculate cost of goods sold during the period.

Ending Inventory

The total value of goods available for sale at the end of an accounting period, calculated by adding new purchases to beginning inventory and subtracting cost of goods sold.

- Understand the impact of inventory errors on financial statements and how to correct them.

Verified Answer

Correct cost of goods sold: \text { Correct cost of goods sold: } Correct cost of goods sold:

Correct cost of goods sold: \text { Correct cost of goods sold: } Correct cost of goods sold: 2014‾2015‾Beginning inventory54,000$57,000Cost of goods purchased847,000‾891,000‾Cost of goods available for sale901,000948,000Ending inventory57,000‾71,000‾Cost of goods sold$844,000‾$877,000‾\begin{array}{lcc}& \underline{2014}& \underline{2015}\\\text {Beginning inventory}&54,000 & \$57,000 \\\text {Cost of goods purchased}& \underline{847,000} & \underline{891,000} \\\text {Cost of goods available for sale}&901,000 & 948, 000 \\\text {Ending inventory}& \underline{ 57,000} & \underline{71,000 }\\\text {Cost of goods sold}& \underline{ \$ 844,000} & \underline{ \$877,000}\end{array}Beginning inventoryCost of goods purchasedCost of goods available for saleEnding inventoryCost of goods sold201454,000847,000901,00057,000$844,0002015$57,000891,000948,00071,000$877,000

Learning Objectives

- Understand the impact of inventory errors on financial statements and how to correct them.

Related questions

Errors Occasionally Occur When Physically Counting Inventory Items on Hand ...

Inventory at the End of the Year Is Overstated ...

If Beginning Inventory Is Understated by $15000 the Effect of ...

Understating Beginning Inventory Will Understate ...

An Error in the Physical Count of Goods on Hand \(\begin{array}{cc} ...