Asked by J’Myaa Tameriaa on Jul 24, 2024

Verified

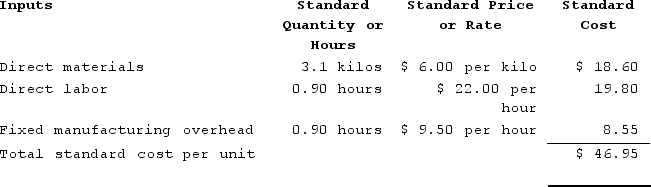

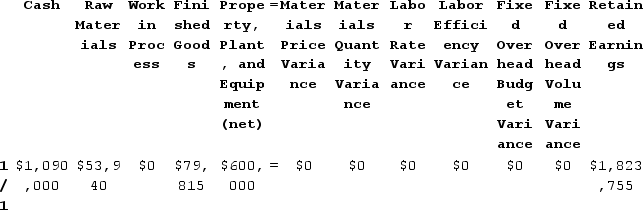

Freiling Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:  During the year, the company assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 14,890 hours at an average cost of $22.80 per hour.Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

During the year, the company assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 14,890 hours at an average cost of $22.80 per hour.Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

When recording the direct labor costs, the Work in Process inventory account will increase (decrease) by:

When recording the direct labor costs, the Work in Process inventory account will increase (decrease) by:

A) $318,780

B) ($339,492)

C) $339,492

D) ($318,780)

Work in Process

A category of inventory representing items currently being manufactured but not yet completed.

Direct Labor

The wages and other costs for labor directly involved in the production of goods or services, excluding indirect labor costs.

Standard Costs

Predetermined costs for materials, labor, and overhead, against which actual costs are compared.

- Acquire knowledge on the trajectory of costs in manufacturing financial accounts, focusing on Work in Process, Finished Goods, and Cost of Goods Sold.

- Log the costs incurred from direct labor and recognize their effect on the price of products.

Verified Answer

SN

Sandeep NagreJul 25, 2024

Final Answer :

A

Explanation :

Direct labor costs are added to Work in Process inventory, so the account will increase by the total direct labor cost incurred, which is 14,890 hours x $22.80 per hour = $339,492.

Learning Objectives

- Acquire knowledge on the trajectory of costs in manufacturing financial accounts, focusing on Work in Process, Finished Goods, and Cost of Goods Sold.

- Log the costs incurred from direct labor and recognize their effect on the price of products.