Asked by Mckennzie Kearns on Jun 11, 2024

Verified

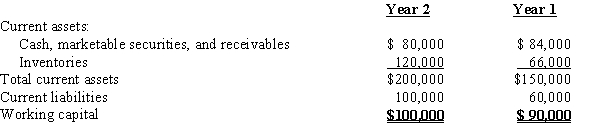

For Garrison Corporation, the working capital at the end of the current year is $10,000 more than the working capital at the end of the preceding year, reported as follows:??  Has the current position of Garrison Corporation improved? Explain.

Has the current position of Garrison Corporation improved? Explain.

Working Capital

The difference between a company's current assets and current liabilities, indicating the short-term financial health and operational efficiency of the business.

Current Position

Refers to the financial status and condition of an entity at a specific point in time, indicating its ability to meet short-term obligations.

- Examine a firm's ability to satisfy its short-term obligations, maintain long-term financial health, and generate profits.

- Comprehend the importance of variations in items of financial statements across different periods.

Verified Answer

MS

Maninder SinghJun 17, 2024

Final Answer :

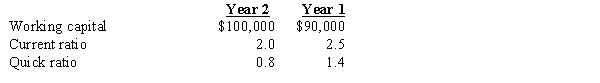

The amount of working capital and the change in working capital are just two indicators of the strength of the current position. A comparison of the current and quick ratios, along with the amount of working capital, gives a better analysis of the current position.  Although working capital has increased, the current ratio has fallen from 2.5 to 2.0, and the quick ratio has fallen from 1.4 to 0.8.Reductions in the current and quick ratios imply that it has become difficult for the company to convert its assets into cash to pay off its short-term liabilities, so the current position has deteriorated.

Although working capital has increased, the current ratio has fallen from 2.5 to 2.0, and the quick ratio has fallen from 1.4 to 0.8.Reductions in the current and quick ratios imply that it has become difficult for the company to convert its assets into cash to pay off its short-term liabilities, so the current position has deteriorated.

Although working capital has increased, the current ratio has fallen from 2.5 to 2.0, and the quick ratio has fallen from 1.4 to 0.8.Reductions in the current and quick ratios imply that it has become difficult for the company to convert its assets into cash to pay off its short-term liabilities, so the current position has deteriorated.

Although working capital has increased, the current ratio has fallen from 2.5 to 2.0, and the quick ratio has fallen from 1.4 to 0.8.Reductions in the current and quick ratios imply that it has become difficult for the company to convert its assets into cash to pay off its short-term liabilities, so the current position has deteriorated.

Learning Objectives

- Examine a firm's ability to satisfy its short-term obligations, maintain long-term financial health, and generate profits.

- Comprehend the importance of variations in items of financial statements across different periods.

Related questions

Cash and Accounts Receivable for Ashfall Co Based on This ...

An Analysis of a Company's Ability to Pay Its Current ...

A Toronto Firm Has a Times Interest Earned Ratio of ...

The Financial Ratio Measured as Net Income Divided by Sales ...

Ash Company Reported Sales of $400,000 for Year 1,$450,000 for ...