Asked by Leanne Mallare on May 17, 2024

Verified

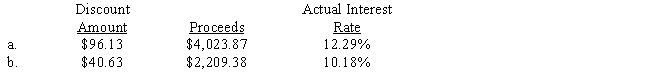

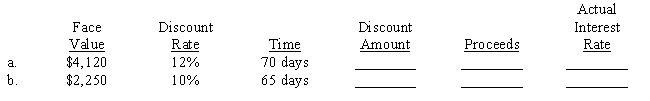

FLR Investment Group, Inc. made the following two loans using a discount rate to compute the charge and then loaned the proceeds to their clients. Compute the amount of discount, the proceeds, and the actual interest rate based upon the proceeds rather than the face value. Use a 360-day year and compute actual rates to the nearest 1/100 of a percent.

Discount Rate

The discount rate is the interest rate set by central banks charged to commercial banks for loans, affecting the cost of borrowing money.

Actual Interest Rate

The real rate of interest earned or paid on an investment or loan, taking into account the effect of compounding.

- Grasp the idea of lowering a loan's face value and the resulting effects on the amount received by the borrower.

- Assess the markdowns and income derived from multiple financing alternatives.

- Estimate the legitimate interest rate by using proceeds instead of the face value, considering the day counts of 365 and 360 days per year.

Verified Answer

CG

Learning Objectives

- Grasp the idea of lowering a loan's face value and the resulting effects on the amount received by the borrower.

- Assess the markdowns and income derived from multiple financing alternatives.

- Estimate the legitimate interest rate by using proceeds instead of the face value, considering the day counts of 365 and 360 days per year.

Related questions

Annamarie Weymeyer Held a $3,750, 120-Day, Non-Interest-Bearing Note Dated July ...

Moneywise Loans and Credit Corp ...

Marcia Driscoll Held a $2,650, 90-Day, Non-Interest-Bearing Note Dated September ...

Sandra Baker Held a $3,500, 70-Day Note Dated March 14 ...

Juan Munoz Held a $1,170, 45-Day, Non-Interest-Bearing Note Dated March ...