Asked by Erika Frederick on Jul 22, 2024

Verified

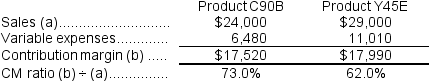

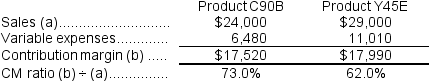

Flesch Corporation produces and sells two products.In the most recent month, Product C90B had sales of $24,000 and variable expenses of $6,480.Product Y45E had sales of $29,000 and variable expenses of $11,010.The fixed expenses of the entire company were $32,280.If the sales mix were to shift toward Product C90B with total dollar sales remaining constant, the overall break-even point for the entire company:

A) would decrease.

B) would increase.

C) could increase or decrease.

D) would not change.

Break-even Point

The level of sales at which total revenues equal total costs, resulting in no net profit or loss.

Sales Mix

Sales mix refers to the combination of different products or services that a company sells, impacting the overall profitability depending on the profit margin of each product or service.

Variable Expenses

Expenses that fluctuate with the level of output or activity, in contrast to fixed expenses that remain constant regardless of activity level.

- Learn how the sales mix impacts the overall break-even point for a company.

Verified Answer

KD

Katie DuggerJul 27, 2024

Final Answer :

A

Explanation :

Since Product C90B has lower variable expenses than Product Y45E, shifting the sales mix towards Product C90B will increase the overall contribution margin for the company. This means that the overall break-even point will decrease, as the company will need to sell fewer units in total to cover its fixed expenses.

Explanation :  Since Product C90B has a higher contribution margin ratio, a shift in sales to that product would decrease the break-even point of the entire company.

Since Product C90B has a higher contribution margin ratio, a shift in sales to that product would decrease the break-even point of the entire company.

Since Product C90B has a higher contribution margin ratio, a shift in sales to that product would decrease the break-even point of the entire company.

Since Product C90B has a higher contribution margin ratio, a shift in sales to that product would decrease the break-even point of the entire company.

Learning Objectives

- Learn how the sales mix impacts the overall break-even point for a company.