Asked by Derek Quach on Jun 05, 2024

Verified

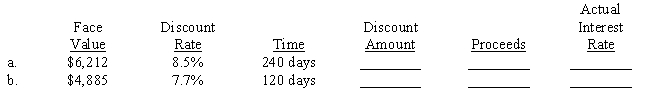

First Republic Bank makes many loans to individuals by discounting the face value of the loan. The borrower gets the proceeds. For the two loans below, determine the amount of the discount, the proceeds, and the actual interest rate which is based on the proceeds rather than the face value. Use a 365-day year and compute actual rates to the nearest 1/100 of a percent.

Non-Interest-Bearing Note

A financial instrument or promissory note that does not accrue interest over time, meaning the borrower repays only the principal amount.

Discount Rate

The interest rate charged to commercial banks and other financial institutions for loans received from a country's central bank.

Actual Interest Rate

The actual rate of interest earned or paid on an investment or loan, considering compounding and other factors, as opposed to the nominal rate.

- Understand the concept of discounting the face value of a loan and how it affects the borrower's proceeds.

- Calculate the amount of discount and proceeds for various loans.

- Determine the actual interest rate based on proceeds rather than the face value using different day counts (365-day and 360-day years).

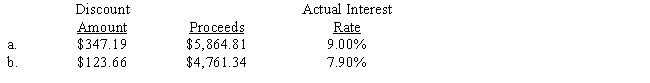

Verified Answer

Learning Objectives

- Understand the concept of discounting the face value of a loan and how it affects the borrower's proceeds.

- Calculate the amount of discount and proceeds for various loans.

- Determine the actual interest rate based on proceeds rather than the face value using different day counts (365-day and 360-day years).

Related questions

Annamarie Weymeyer Held a $3,750, 120-Day, Non-Interest-Bearing Note Dated July ...

Sandra Baker Held a $3,500, 70-Day Note Dated March 14 ...

Wei Fang Food Importers Often Tries to Take Advantage of ...

Moneywise Loans and Credit Corp ...

Juan Munoz Held a $1,170, 45-Day, Non-Interest-Bearing Note Dated March ...