Asked by Shehroze Tariq on Jun 20, 2024

Verified

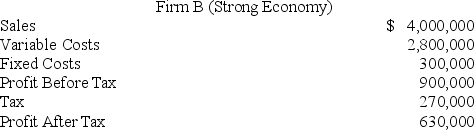

Firm B produces gadgets. The price of gadgets is $2 each. Firm B has total fixed costs of $300,000 and variable costs of $1.40 per gadget. The corporate tax rate is 30%. If the economy is strong, the firm will sell 2,000,000 gadgets. If the economy enters a recession, the firm will sell only half as many gadgets. If the economy is strong, the after-tax profit of firm B will be ________.

A) $90,000

B) $210,000

C) $300,000

D) $630,000

Fixed Costs

Business expenses that remain the same regardless of the level of production or sales, such as rent, salaries, or loan payments.

Variable Costs

Costs that vary directly with the level of output or production activity.

Corporate Tax Rate

The percentage of a corporation's profits that must be paid to the government as tax.

- Understand the elements that influence an organization's susceptibility to economic fluctuations, encompassing financial leverage, operating leverage, and the nature of products.

- Understand the impact of diverse economic environments on investment choices across various sectors.

Verified Answer

CT

Learning Objectives

- Understand the elements that influence an organization's susceptibility to economic fluctuations, encompassing financial leverage, operating leverage, and the nature of products.

- Understand the impact of diverse economic environments on investment choices across various sectors.