Asked by Travis Entwisle on Jun 13, 2024

Verified

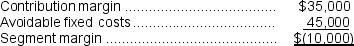

Fabri Corporation is considering eliminating a department that has an annual contribution margin of $35,000 and $70,000 in annual fixed costs.Of the fixed costs, $25,000 cannot be avoided.The annual financial advantage (disadvantage) for the company of eliminating this department would be:

A) $10,000

B) ($10,000)

C) $35,000

D) ($35,000)

Contribution Margin

The difference between sales revenue and variable costs, which contributes to covering fixed costs and generating profit.

Fixed Costs

Costs that do not change with the level of output or activity, such as rent or salaries.

Financial Advantage

A benefit gained in terms of monetary gains or improved financial position, often resulting from investments, operational efficiency, or strategic decisions.

- Scrutinize the outcomes of discontinuing a product or department on the company's total net operating income.

Verified Answer

If the department were eliminated, the company would eliminate the department's negative segment margin of $10,000.

If the department were eliminated, the company would eliminate the department's negative segment margin of $10,000.

Learning Objectives

- Scrutinize the outcomes of discontinuing a product or department on the company's total net operating income.

Related questions

The Following Information Relates to Next Year's Projected Operating Results ...

Kahn Corporation (A Multi-Product Company)produces and Sells 8,000 Units of ...

When a Segment of a Company Is Showing a Net ...

Use the Data Below for Coffee & Cocoa Company ...

Assume That Discontinuing the Manufacture and Sale of Product J ...