Asked by SIMNIKIWE MASIKITI on May 11, 2024

Verified

Fabert Corporation uses the weighted-average method in its process costing system.The Assembly Department started the month with 16,000 units in its beginning work in process inventory that were 40% complete with respect to conversion costs.An additional 60,000 units were transferred in from the prior department during the month to begin processing in the Assembly Department.During the month 65,000 units were completed in the Assembly Department and transferred to the next processing department.There were 11,000 units in the ending work in process inventory of the Assembly Department that were 50% complete with respect to conversion costs. What were the equivalent units for conversion costs in the Assembly Department for the month?

A) 65,000

B) 70,500

C) 64,100

D) 55,000

Weighted-Average Method

A cost accounting method that calculates the cost per unit of inventory based on the average cost of all similar items in the inventory.

Conversion Costs

The cumulative costs of direct labor and manufacturing overhead that are incurred to convert raw materials into finished goods.

Assembly Department

A division within a manufacturing facility where parts are put together to form finished products.

- Calculate the equivalent units related to materials and conversion expenditures utilizing the weighted-average technique.

Verified Answer

NJ

Nautiay JohnsonMay 13, 2024

Final Answer :

B

Explanation :

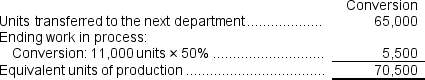

The equivalent units for conversion costs can be calculated as:

EU = Units completed + (Ending WIP inventory * % complete)

EU = 65,000 + (11,000 * 50%)

EU = 65,000 + 5,500

EU = 70,500

Therefore, the equivalent units for conversion costs in the Assembly Department for the month is 70,500, which means the best choice is B.

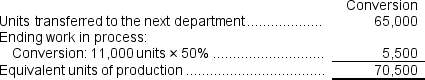

EU = Units completed + (Ending WIP inventory * % complete)

EU = 65,000 + (11,000 * 50%)

EU = 65,000 + 5,500

EU = 70,500

Therefore, the equivalent units for conversion costs in the Assembly Department for the month is 70,500, which means the best choice is B.

Explanation :

Weighted-average method

Learning Objectives

- Calculate the equivalent units related to materials and conversion expenditures utilizing the weighted-average technique.