Asked by Laura-Leigh Holley on May 09, 2024

Verified

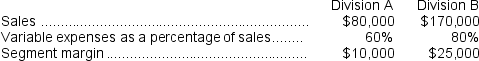

Eyestone Corporation has two divisions, A and B.The following data pertain to operations in October:  If common fixed expenses were $17,000, total fixed expenses were:

If common fixed expenses were $17,000, total fixed expenses were:

A) $48,000

B) $13,000

C) $31,000

D) $53,000

Common Fixed Expenses

Expenses that do not vary with the level of production or sales, and are shared across different segments or products of a company.

Total Fixed Expenses

The cumulative amount of all expenses that do not change with the level of production or sales within a certain range and period.

Division A

A designated segment or business unit within a larger organization, typically focused on a specific product line or market sector.

- Distinguish and compute the impact of traceable and shared fixed costs on the financial outcomes of both divisions and the entire corporation.

Verified Answer

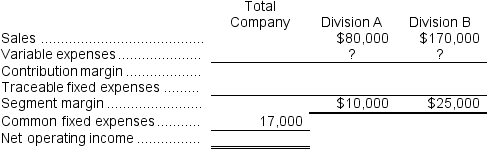

Division A:

Division A:Variable expenses = Variable expense ratio × Sales

= 0.60 × $80,000 = $48,000

Division B:

Variable expenses = Variable expense ratio × Sales

= 0.80 × $170,000 = $136,000

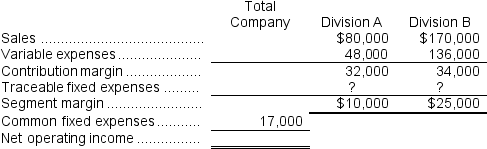

Division A:

Division A:Segment margin = Contribution margin - Traceable fixed expenses

$10,000 = $32,000 - Traceable fixed expenses

Traceable fixed expenses = $32,000 - $10,000 = $22,000

Division B:

Segment margin = Contribution margin - Traceable fixed expenses

$25,000 = $34,000 - Traceable fixed expenses

Traceable fixed expenses = $34,000 - $25,000 = $9,000

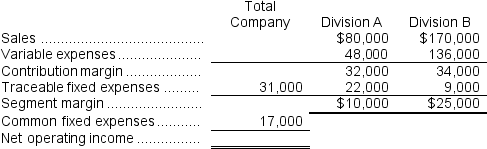

Total fixed expenses = Traceable fixed expenses + Common fixed expenses

Total fixed expenses = Traceable fixed expenses + Common fixed expenses= $31,000 + $17,000 = $48,000

Learning Objectives

- Distinguish and compute the impact of traceable and shared fixed costs on the financial outcomes of both divisions and the entire corporation.

Related questions

Younie Corporation Has Two Divisions: the South Division and the ...

Uchimura Corporation Has Two Divisions: the AFE Division and the ...

WV Construction Has Two Divisions: Remodeling and New Home Construction ...

Holts Corporation Has Two Divisions: Xi and Sigma ...

Thomason Corporation Has Provided the Following Contribution Format Income Statement ...