Asked by Jessica Braga on Jun 24, 2024

Verified

Explain the relation between risk and correlation among assets in a portfolio.

Correlation Among Assets

A measure indicating the degree to which two or more assets move in relation to each other.

Portfolio

A collection of financial investments like stocks, bonds, commodities, cash, and cash equivalents, including their fund counterparts.

- Understand the relationship between risk and correlation in portfolio management.

Verified Answer

MF

Markelle FletcherJun 30, 2024

Final Answer :

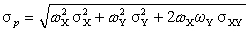

Risk depends on the correlation among assets in a portfolio.This can be seen by examining the formula for the standard deviation of a two-asset portfolio:  Here,σXY is the covariance between X and Y.If the covariance is zero,the variance of the portfolio is simply a weighted sum of the individual variances.If the covariance is negative,the standard deviation of the portfolio is smaller,while if the covariance is positive,the standard deviation of the portfolio is larger.Thus,if two investments are positively correlated,the overall risk increases,for if the stock price of one falls,the other would generally fall also.However,if two investments are negatively correlated,when one increases,the other decreases,reducing the overall risk.This is why financial experts advise diversification.

Here,σXY is the covariance between X and Y.If the covariance is zero,the variance of the portfolio is simply a weighted sum of the individual variances.If the covariance is negative,the standard deviation of the portfolio is smaller,while if the covariance is positive,the standard deviation of the portfolio is larger.Thus,if two investments are positively correlated,the overall risk increases,for if the stock price of one falls,the other would generally fall also.However,if two investments are negatively correlated,when one increases,the other decreases,reducing the overall risk.This is why financial experts advise diversification.

Here,σXY is the covariance between X and Y.If the covariance is zero,the variance of the portfolio is simply a weighted sum of the individual variances.If the covariance is negative,the standard deviation of the portfolio is smaller,while if the covariance is positive,the standard deviation of the portfolio is larger.Thus,if two investments are positively correlated,the overall risk increases,for if the stock price of one falls,the other would generally fall also.However,if two investments are negatively correlated,when one increases,the other decreases,reducing the overall risk.This is why financial experts advise diversification.

Here,σXY is the covariance between X and Y.If the covariance is zero,the variance of the portfolio is simply a weighted sum of the individual variances.If the covariance is negative,the standard deviation of the portfolio is smaller,while if the covariance is positive,the standard deviation of the portfolio is larger.Thus,if two investments are positively correlated,the overall risk increases,for if the stock price of one falls,the other would generally fall also.However,if two investments are negatively correlated,when one increases,the other decreases,reducing the overall risk.This is why financial experts advise diversification.

Learning Objectives

- Understand the relationship between risk and correlation in portfolio management.

Related questions

You Are Considering Adding a New Security to Your Portfolio ...

Investing in Two Assets with a Correlation Coefficient of - ...

A Portfolio Is Composed of Two Stocks, a and B ...

You Are Constructing a Scatter Plot of Excess Returns for ...

To Construct a Riskless Portfolio Using Two Risky Stocks, One ...