Asked by Teesean Patterson on Jun 04, 2024

Verified

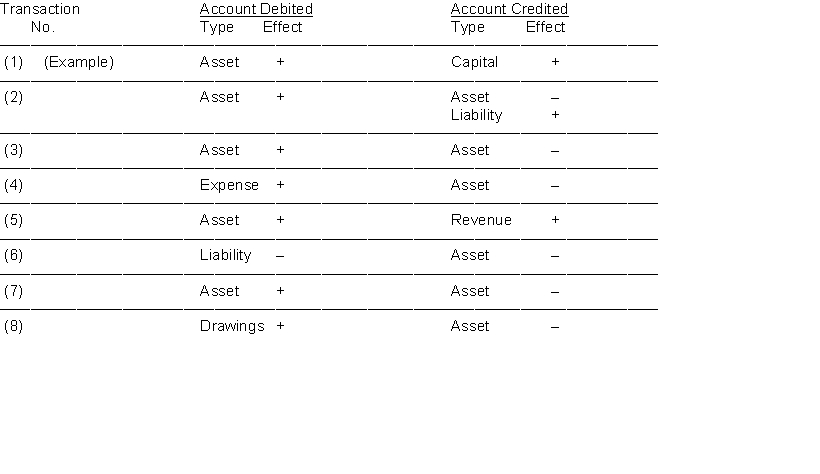

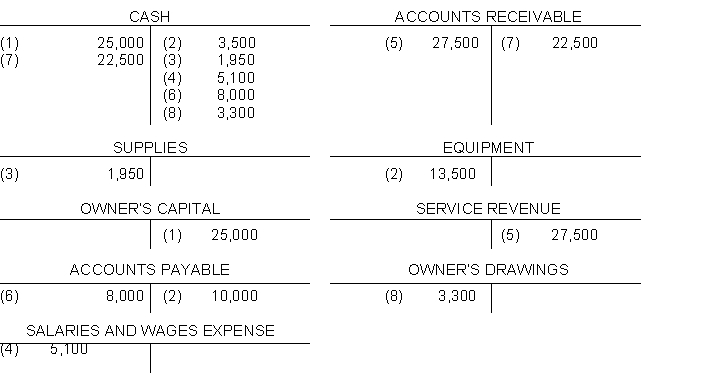

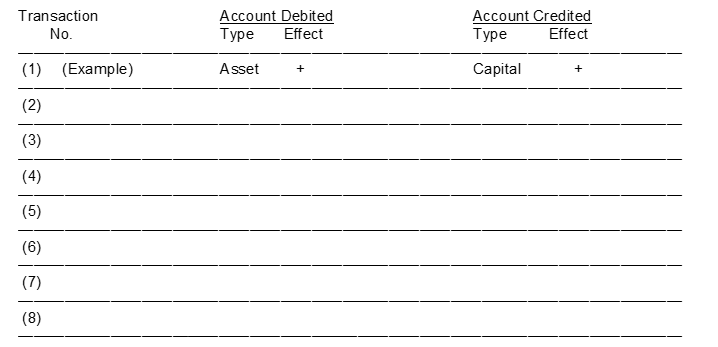

Eight transactions are recorded in the following T-accounts:  Indicate for each debit and each credit: (a) whether an asset liability capital drawing revenue or expense account was affected and (b) whether the account was increased (+) or (-) decreased. Answers should be presented in the following chart form:

Indicate for each debit and each credit: (a) whether an asset liability capital drawing revenue or expense account was affected and (b) whether the account was increased (+) or (-) decreased. Answers should be presented in the following chart form:

T-Accounts

T-Accounts are a form of accounting ledger that visually represents the debits and credits of financial transactions for each account in double-entry bookkeeping.

Capital Drawing

Withdrawals made by the owner(s) from the business for personal use, reducing the total capital invested in the business.

- Gain insight into the core principles of double-entry accounting along with the conventional balance for distinct account types.

- Learn the suitable methodology for addressing business events (amplifications and depreciations) within the double-entry recording system.

Verified Answer

AA

Learning Objectives

- Gain insight into the core principles of double-entry accounting along with the conventional balance for distinct account types.

- Learn the suitable methodology for addressing business events (amplifications and depreciations) within the double-entry recording system.