Asked by Bryan Cakir on May 28, 2024

Verified

Donna is considering the option of becoming a co-owner in a business. Her investment choices are to hold a risk free asset that has a return of  and co-ownership of the business, which has a rate of return of

and co-ownership of the business, which has a rate of return of  and a level of risk of

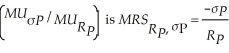

and a level of risk of  . Donna's marginal rate of substitution of return for risk

. Donna's marginal rate of substitution of return for risk  where

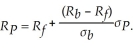

where  is Donna's portfolio rate of return and σP is her optimal portfolio risk. Donna's budget constraint is given by

is Donna's portfolio rate of return and σP is her optimal portfolio risk. Donna's budget constraint is given by  Solve for Donna's optimal portfolio rate of return and risk as a function of

Solve for Donna's optimal portfolio rate of return and risk as a function of  ,

,  and

and  . Suppose the table below lists the relevant rates of returns and risks. Use this table to determine Donna's optimal rate or return and risk.

. Suppose the table below lists the relevant rates of returns and risks. Use this table to determine Donna's optimal rate or return and risk.

Investment Rate of Return Risk

Risk Free 0.06 0

Business 0.25 0.39

Risk Free Asset

An investment that is expected to return its original value without any loss and with a certain rate of interest; considered to have zero default risk.

Rate of Return

The increase or decrease in the value of an investment during a set time frame, represented as a proportion of the investment's original price.

Level of Risk

The degree of uncertainty associated with an investment or decision, often regarding the potential for loss.

- Implement the principle of utility maximization when choosing portfolios.

- Gain insight into how standard deviation functions as an indicator of risk in portfolios composed of risk-bearing and risk-free assets.

- Appraise financial decision-making using the marginal rate of substitution (MRS) to improve the allocation of resources in a portfolio.

Verified Answer

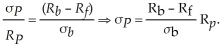

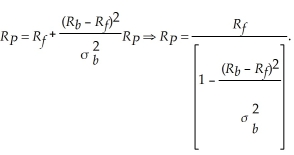

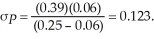

We may then substitute this level of portfolio risk into her budget constraint to find her optimal rate of return

We may then substitute this level of portfolio risk into her budget constraint to find her optimal rate of return  We can plug this optimal portfolio return into the expression for portfolio risk above and get:

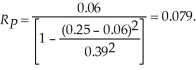

We can plug this optimal portfolio return into the expression for portfolio risk above and get:  Using the values from the table, we see that Donna's optimal portfolio return is

Using the values from the table, we see that Donna's optimal portfolio return is  Donna's optimal portfolio risk is

Donna's optimal portfolio risk is

Learning Objectives

- Implement the principle of utility maximization when choosing portfolios.

- Gain insight into how standard deviation functions as an indicator of risk in portfolios composed of risk-bearing and risk-free assets.

- Appraise financial decision-making using the marginal rate of substitution (MRS) to improve the allocation of resources in a portfolio.

Related questions

Assume That an Investor Invests in One Risky and One ...

The Standard Deviation of a Two-Asset Portfolio (With a Risky ...

Consider the Following Statements When Answering This Question: I ...

Standard Deviation Measures the _____ Risk of a Security ...

Which One of the Following Statements Is Correct Concerning the ...