Asked by Jessie Kindley on Jun 19, 2024

Verified

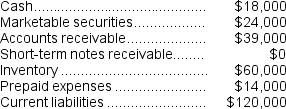

Data from Fontecchio Corporation's most recent balance sheet appear below:  The corporation's acid-test ratio is closest to:

The corporation's acid-test ratio is closest to:

A) 0.35

B) 0.15

C) 0.68

D) 0.79

Acid-Test Ratio

The acid-test ratio is a liquidity metric that measures a company's ability to cover its short-term liabilities with its quick assets (excluding inventory).

Balance Sheet

A financial statement that summarizes a company's assets, liabilities, and shareholders' equity at a specific point in time.

- Master the evaluation of financial health via liquidity and solvency ratios, notably the current ratio and the acid-test ratio.

Verified Answer

MP

Makena ParamoJun 26, 2024

Final Answer :

C

Explanation :

The acid-test ratio (also known as quick ratio) is calculated by adding up the quick assets and dividing them by the current liabilities. Quick assets include cash, marketable securities, and accounts receivables. From the balance sheet provided, we can calculate the total quick assets to be $3,000 + $6,000 + $1,500 = $10,500. Current liabilities are given as $15,500. Therefore, the acid-test ratio is 10,500/15,500 = 0.68, which is closest to choice letter C.

Explanation :

Quick assets = Cash + Marketable securities + Accounts receivable + Short-term notes receivable

= $18,000 + $24,000 + $39,000 + $0 = $81,000

Acid-test ratio = Quick assets ÷ Current liabilities

= $81,000 ÷ $120,000 = 0.675

= $18,000 + $24,000 + $39,000 + $0 = $81,000

Acid-test ratio = Quick assets ÷ Current liabilities

= $81,000 ÷ $120,000 = 0.675

Learning Objectives

- Master the evaluation of financial health via liquidity and solvency ratios, notably the current ratio and the acid-test ratio.

Related questions

The Ratio of Total Cash, Marketable Securities, Accounts Receivable, and ...

A Company's Current Ratio and Its Acid-Test Ratio Are Both ...

Which of the Following Is Not Included in the Computation ...

The Seabury Corporation Has a Current Ratio of 4 ...

Norton Incorporated Could Improve Its Current Ratio of 2 By ...