Asked by Emily Yannatone on May 08, 2024

Verified

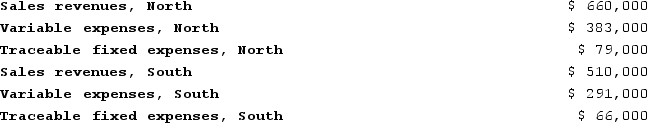

Data for January for Bondi Corporation and its two major business segments, North and South, appear below:  In addition, common fixed expenses totaled $179,000 and were allocated as follows: $93,000 to the North business segment and $86,000 to the South business segment.A properly constructed segmented income statement in a contribution format would show that the net operating income of the company as a whole is:

In addition, common fixed expenses totaled $179,000 and were allocated as follows: $93,000 to the North business segment and $86,000 to the South business segment.A properly constructed segmented income statement in a contribution format would show that the net operating income of the company as a whole is:

A) $(7,000)

B) $172,000

C) $351,000

D) $496,000

Segmented Income Statement

An income statement broken down into parts or segments, typically showing revenues, expenses, and profits for individual units, products, or departments within an organization.

Contribution Format

A way of presenting income statements where costs are separated into variable and fixed, and contribution margin is highlighted.

Common Fixed Expenses

Costs that do not vary with the level of production or sales and are shared among different segments of a business.

- Ascertain the net operating income for a corporation by examining the results of its diverse segments.

Verified Answer

JD

Jalee DavisMay 12, 2024

Final Answer :

B

Explanation :

To prepare a segmented income statement in a contribution format, we need to separate the costs into variable and fixed costs, and allocate the fixed costs to each segment based on some reasonable criteria, such as revenue or contribution margin.

First, let's calculate the contribution margin for each segment:

North:

Sales $1,500,000

Variable expenses:

Cost of goods sold ($750,000)

Commissions ($90,000)

Other variable expenses ($135,000)

Contribution margin $525,000

South:

Sales $2,500,000

Variable expenses:

Cost of goods sold ($1,625,000)

Commissions ($200,000)

Other variable expenses ($300,000)

Contribution margin $375,000

Next, we allocate the common fixed expenses:

North:

Contribution margin $525,000

Common fixed expenses ($93,000)

Segment margin $432,000

South:

Contribution margin $375,000

Common fixed expenses ($86,000)

Segment margin $289,000

Finally, we calculate the net operating income of the company as a whole:

Segment margin (North) $432,000

Segment margin (South) $289,000

Common fixed expenses ($179,000)

Net operating income $542,000

Therefore, the answer is B, $172,000.

First, let's calculate the contribution margin for each segment:

North:

Sales $1,500,000

Variable expenses:

Cost of goods sold ($750,000)

Commissions ($90,000)

Other variable expenses ($135,000)

Contribution margin $525,000

South:

Sales $2,500,000

Variable expenses:

Cost of goods sold ($1,625,000)

Commissions ($200,000)

Other variable expenses ($300,000)

Contribution margin $375,000

Next, we allocate the common fixed expenses:

North:

Contribution margin $525,000

Common fixed expenses ($93,000)

Segment margin $432,000

South:

Contribution margin $375,000

Common fixed expenses ($86,000)

Segment margin $289,000

Finally, we calculate the net operating income of the company as a whole:

Segment margin (North) $432,000

Segment margin (South) $289,000

Common fixed expenses ($179,000)

Net operating income $542,000

Therefore, the answer is B, $172,000.

Learning Objectives

- Ascertain the net operating income for a corporation by examining the results of its diverse segments.