Asked by Nadia Kovacs on May 12, 2024

Verified

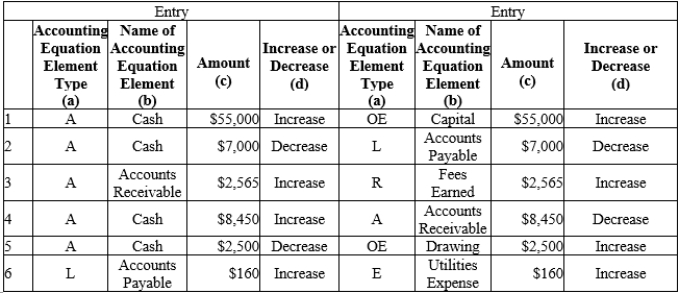

Daniels Company is owned and operated by Thomas Daniels. The following selected transactions were completed by Daniels Company during May:

1.Received cash from owner as additional investment, $55,000.

2.Paid creditors on account, $7,000.

3.Billed customers for services on account, $2,565.

4.Received cash from customers on account, $8,450.

5.Paid cash to owner for personal use, $2,500.

6.Received the utility bill, $160, to be paid next month.

?Indicate the effect of each transaction on the accounting equation by:

(a)Accounting equation element type: (A) assets, (L) liabilities, (OE) owner's equity, (R) revenue, and (E) expense

b)Name of accounting equation element

c)The amount of the transaction

d)The direction of change

(increase or decrease) in the account affected

Note: Each transaction has two entries.?

Accounting Equation

The foundation of double-entry bookkeeping, which asserts that assets equal the sum of liabilities and shareholders' equity.

Owner's Equity

The residual interest in the assets of an entity after deducting liabilities; it represents the ownership interest of the shareholders or owner in the company.

Assets

Resources owned by a company from which future economic benefits are expected to flow to the entity.

- Comprehend how various transactions influence the accounting equation.

- Identify the types of transactions that influence owner's equity.

Verified Answer

JS

Learning Objectives

- Comprehend how various transactions influence the accounting equation.

- Identify the types of transactions that influence owner's equity.