Asked by Morgan Whittle on Jul 06, 2024

Verified

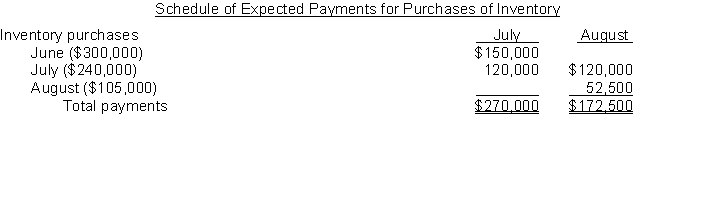

Cruises Inc. has budgeted sales revenues as follows: June July August Credit sales $135,000$125,000$90,000 Cash sales 90,000255,000195,000 Total sales $225.000$380,000$285,000\begin{array}{lccc} & \text { June } & \text { July } & \text { August } \\ \text { Credit sales } & \$ 135,000 & \$ 125,000 & \$ 90,000 \\\text { Cash sales } & 90,000 & 255,000 & 195,000 \\ \text { Total sales } & \$ 225.000 & \$ 380,000 & \$ 285,000 \\\end{array} Credit sales Cash sales Total sales June $135,00090,000$225.000 July $125,000255,000$380,000 August $90,000195,000$285,000 Past experience indicates that 60% of the credit sales will be collected in the month of sale and the remaining 40% will be collected in the following month. Purchases of inventory are all on credit and 50% is paid in the month of purchase and 50% in the month following purchase. Budgeted inventory purchases are: June $300,000 July 240,000 August 105,000\begin{array} { l r } \text { June } & \$ 300,000 \\\text { July } & 240,000 \\\text { August } & 105,000\end{array} June July August $300,000240,000105,000 Other cash disbursements budgeted: (a) selling and administrative expenses of $48000 each month (b) dividends of $103000 will be paid in July and (c) purchase of equipment in August for $30000 cash.

The company wishes to maintain a minimum cash balance of $50000 at the end of each month. The company borrows money from the bank at 6% interest if necessary to maintain the minimum cash balance. Borrowed money is repaid in months when there is an excess cash balance. The beginning cash balance on July 1 was $50000. Assume that borrowed money in this case is for one month.

Instructions

Prepare a cash budget for the months of July and August. Prepare separate schedules for expected collections from customers and expected payments for purchases of inventory.

Inventory Purchases

The total cost associated with buying goods and materials kept in stock for the purpose of resale or production in a given period.

Administrative Expenses

Costs related to the general operation of a company, such as salaries of executive personnel, legal fees, and insurance.

Minimum Cash Balance

The least amount of cash that a company aims to hold in its accounts to meet immediate operational needs.

- Review and outline cash budget forecasts, including anticipated cash inflows and expenditures.

- Familiarize oneself with the methodologies for approximating collections derived from sales and the expenses paid out, considering their timing and total values.

Verified Answer

MM

Learning Objectives

- Review and outline cash budget forecasts, including anticipated cash inflows and expenditures.

- Familiarize oneself with the methodologies for approximating collections derived from sales and the expenses paid out, considering their timing and total values.