Asked by hennebry waters on Jul 03, 2024

Verified

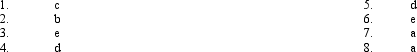

Costs incurred by Mills Company that relate to its property, plant, and equipment assets might be recorded in one of the five following classes of accounts:

a. an expense account

b. an accumulated depreciation accoun

c. a land account

d. a building account

e. an equipment account Required:

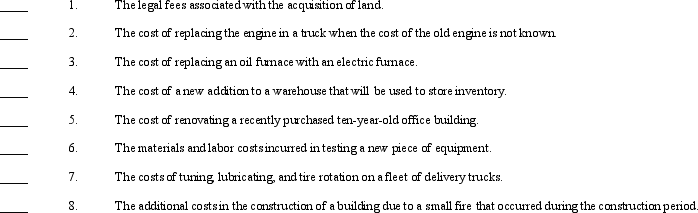

For each of the costs identified below, indicate the type of account in which the cost should be recorded by placing the appropriate letter in the space provided.

Accumulated Depreciation

Accumulated depreciation is the total amount of depreciation expense that has been recorded against a company's assets over time.

Expense Account

An account in financial accounting that represents costs incurred by a company during a period, not directly tied to the production of goods or services.

Equipment Account

An account where the cost of purchased equipment is recorded, reflecting the total value of equipment owned by a business.

- Classify costs related to property, plant, and equipment into appropriate accounts.

Verified Answer

AK

Learning Objectives

- Classify costs related to property, plant, and equipment into appropriate accounts.