Asked by Lilian Cohaus on Jul 21, 2024

Verified

Commander Appliance Store prepares annual financial statements.At December 31,2019.Commander needs to analyze the following items to determine the whether adjusting entries are required for 2019.

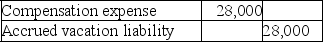

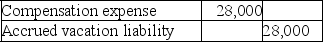

1.Twenty-two employees worked during 2019 and each of them will take two weeks of vacation in 2020.Twelve of these employees earn $500 per week and 10 employees earn $800 per week.(If an adjusting entry is required,ignore payroll taxes on this item. )

2.Office rent for January,2020 has not yet been paid.

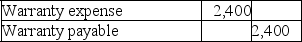

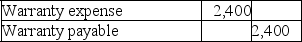

3.Commander sold 3,000 coffee brewing machines for total sales of $150,000.Commander expects that 30 machines will need warranty repairs in the next two years and estimates the cost of repairs to be $2,400.

4.Commander has been sued by a customer and assesses the probability of losing the lawsuit to be reasonably possible.The estimate of the contingency loss is $20,000.

For each item listed,determine whether there should be an accrual and adjusting entry at December 31,2019.If so,then prepare the adjusting entry.If not,state the reason for not accruing a liability.

Warranty Repairs

Services offered to fix or replace defective products within a specified period, as guaranteed by the warranty terms.

Contingency Loss

A potential financial loss that may occur in the future due to uncertain events or conditions.

- Recognize the need for and preparation of adjusting entries for accrued expenses, prepaid expenses, and contingencies.

Verified Answer

AN

Alungile NqwenyanaJul 26, 2024

Final Answer :

1.

2.No accrual for this year (2019)because the rent is for the next year (2020).

2.No accrual for this year (2019)because the rent is for the next year (2020).

3.

4.No accrual because a contingency that is reasonably possible and reasonably estimated need only be disclosed in the notes to the financial statements.

4.No accrual because a contingency that is reasonably possible and reasonably estimated need only be disclosed in the notes to the financial statements.

2.No accrual for this year (2019)because the rent is for the next year (2020).

2.No accrual for this year (2019)because the rent is for the next year (2020).3.

4.No accrual because a contingency that is reasonably possible and reasonably estimated need only be disclosed in the notes to the financial statements.

4.No accrual because a contingency that is reasonably possible and reasonably estimated need only be disclosed in the notes to the financial statements.

Learning Objectives

- Recognize the need for and preparation of adjusting entries for accrued expenses, prepaid expenses, and contingencies.

Related questions

The Adjusting Entry to Record the Salaries Earned Due to ...

The Correct Adjusting Entry for Accrued and Unpaid Employee Salaries ...

Celebraty Printings Sold Annual Subscriptions to Their Magazine for $33000 ...

On June 1, 2010, Barker Industries Purchased a One-Year Comprehensive ...

Identify the Impact on the Balance Sheet If the Following ...