Asked by heidy anastasia on May 14, 2024

Verified

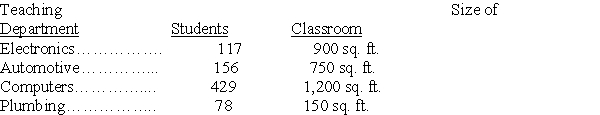

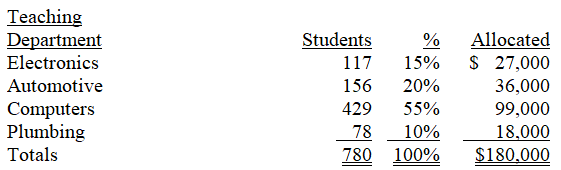

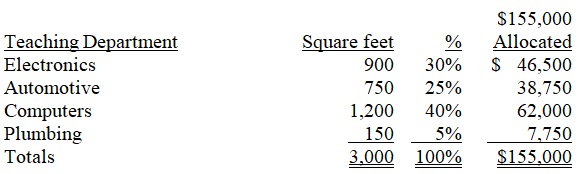

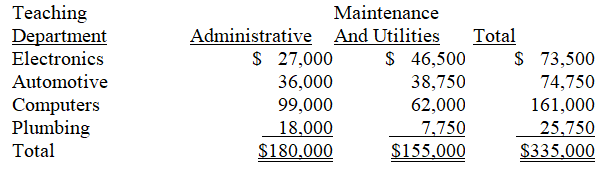

City Park College allocates administrative costs to its teaching departments based on the number of students enrolled,while maintenance and utilities are allocated based on square feet of classrooms.Based on the information below,what is the total amount of expenses allocated to each department (rounded to the nearest dollar)if administrative costs for the college were $180,000,maintenance expenses were $70,000,and utilities were $85,000?

Administrative Costs

Expenses related to the general operation of a business, including salaries of executive officers, legal and clerical work, and office supplies.

Maintenance Expenses

Costs incurred to keep an asset in working condition or to maintain its operational efficiency.

Utilities

Services provided to the public, including electricity, gas, water, and sewage services, typically requiring payment.

- Execute the distribution of departmental costs by utilizing different methods including purchase orders or the measurement of area in square feet.

Verified Answer

Allocation of Maintenance and Utilities expenses of $70,000 + $85,000:

Learning Objectives

- Execute the distribution of departmental costs by utilizing different methods including purchase orders or the measurement of area in square feet.

Related questions

Windermere Corporation Has 55,000 Square Feet in Department A; 20,000 ...

The Total Amount of Indirect Factory Expenses That Should Be ...

The Amount of the Advertising Cost That Should Be Allocated ...

The Amount of Maintenance Expenses That Should Be Allocated to ...

The Amount of Depreciation That Should Be Allocated to Grinding ...