Asked by Karina Garcia on May 03, 2024

Verified

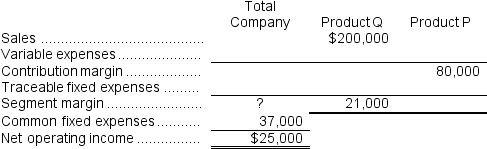

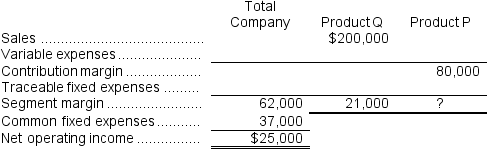

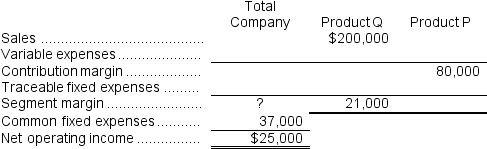

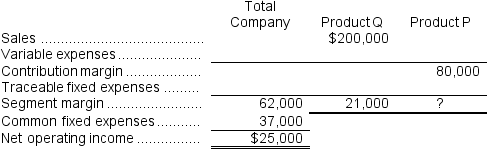

Carroll Corporation has two products, Q and P.During June, the company's net operating income was $25,000, and the common fixed expenses were $37,000.The contribution margin ratio for Product Q was 30%, its sales were $200,000, and its segment margin was $21,000.If the contribution margin for Product P was $80,000, the segment margin for Product P was:

A) $62,000

B) $59,000

C) $62,000

D) $41,000

Segment Margin

The amount of profit or loss produced by a particular segment of a business, considering only the revenues and expenses directly attributable to that segment.

Contribution Margin

The difference between sales revenue and variable costs, indicating how much revenue contributes to fixed costs and profit.

- Perceive the significance of segment margins and common fixed charges in shaping the overall net operating income.

- Recognize and compute contribution margins as well as gross margins.

Verified Answer

ZK

Zybrea KnightMay 05, 2024

Final Answer :

D

Explanation :  Net operating income = Segment margin - Common fixed expenses

Net operating income = Segment margin - Common fixed expenses

$25,000 = Segment margin - $37,000

Segment margin = $25,000 + $37,000 = $62,000 Total segment margin = Product Q segment margin + Product P segment margin

Total segment margin = Product Q segment margin + Product P segment margin

$62,000 = $21,000 + Product P segment margin

Product P segment margin = $62,000 - $21,000 = $41,000

Net operating income = Segment margin - Common fixed expenses

Net operating income = Segment margin - Common fixed expenses$25,000 = Segment margin - $37,000

Segment margin = $25,000 + $37,000 = $62,000

Total segment margin = Product Q segment margin + Product P segment margin

Total segment margin = Product Q segment margin + Product P segment margin$62,000 = $21,000 + Product P segment margin

Product P segment margin = $62,000 - $21,000 = $41,000

Learning Objectives

- Perceive the significance of segment margins and common fixed charges in shaping the overall net operating income.

- Recognize and compute contribution margins as well as gross margins.

Related questions

Younie Corporation Has Two Divisions: the South Division and the ...

Combe Corporation Has Two Divisions: Alpha and Beta ...

Uchimura Corporation Has Two Divisions: the AFE Division and the ...

Goldfarb Company Manufactures and Sells Toasters ...

The Contribution Margin Per Composite Unit for the Current Sales ...