Asked by Hamish Harries on Jul 06, 2024

Verified

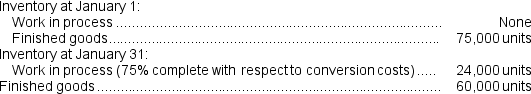

Carrington Corporation produces canned vegetable soup.The company uses the weighted-average method in its process costing system.The company sold 300,000 units in January.Data concerning inventories follow:  What were the equivalent units for conversion costs for January?

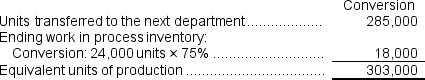

What were the equivalent units for conversion costs for January?

A) 285,000 units.

B) 303,000 units

C) 300,000 units

D) 309,000 units

Canned Vegetable Soup

This refers to a preserved, ready-to-eat soup product that contains various vegetables.

Weighted-Average Method

A method for valuing inventory that calculates the cost of inventory based on the average cost of all comparable items available throughout the period, adjusted by their weighted importance.

Process Costing

An accounting methodology used for homogeneous products, attributing costs to units of product on an average basis.

- Absorb the idea and deployment of equivalent units of production in the realm of a process costing system.

- Analyze data to determine equivalent production units, unit costs, and total costs in a process costing environment.

Verified Answer

Units in beginning work in process inventory + Units started into production or transferred in = Units in ending work in process inventory + Units completed and transferred out

Finished Goods Inventory:

75,000 + Units completed and transferred to finished goods = 60,000 + 250,000

Units completed and transferred to finished goods = 60,000 + 300,000 - 75,000 = 285,000

Learning Objectives

- Absorb the idea and deployment of equivalent units of production in the realm of a process costing system.

- Analyze data to determine equivalent production units, unit costs, and total costs in a process costing environment.

Related questions

What Are the Molding Department's Equivalent Units Related to Conversion ...

Vallin Manufacturing Corporation's Beginning Work in Process Inventory Consisted of ...

What Are the Molding Department's Equivalent Units Related to Materials ...

Equivalent Units of Production Are Always the Same as the ...

Yield Measures the Ratio of the Materials Output Quantity to ...