Asked by Nadia Kovacs on May 27, 2024

Verified

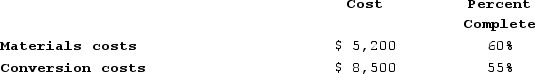

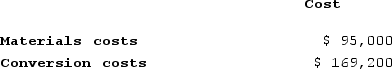

Carpenter Corporation uses the weighted-average method in its process costing system. This month, the beginning inventory in the first processing department consisted of 600 units. The costs and percentage completion of these units in beginning inventory were:  A total of 7,800 units were started and 7,100 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

A total of 7,800 units were started and 7,100 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

The ending inventory was 85% complete with respect to materials and 70% complete with respect to conversion costs.What are the equivalent units for conversion costs for the month in the first processing department?

The ending inventory was 85% complete with respect to materials and 70% complete with respect to conversion costs.What are the equivalent units for conversion costs for the month in the first processing department?

A) 910

B) 8,010

C) 7,100

D) 8,400

Conversion Costs

The costs associated with converting raw materials into finished goods, including labor and overhead but excluding the cost of the raw materials themselves.

Equivalent Units

A concept used in cost accounting to express the amount of work done by various components of a manufacturing process in terms of fully completed units.

Weighted-Average Method

The weighted-average method is an inventory costing method that assigns the average cost of all similar items in inventory to the cost of goods sold and ending inventory, smoothing out price fluctuations.

- Determine equivalent units for conversion expenses.

Verified Answer

Units transferred out = 7,100

Equivalent units in ending inventory =

Conversion costs: 600 x 70% + (7,800 - 6,700) x 100% x 100% = 420 + 1,100 = 1,520

Total equivalent units for conversion costs = 7,100 + 1,520 = 8,620

Since the weighted-average method averages the percentage completion of beginning inventory with the percentage completion of units started during the period, the equivalent units for conversion costs will include both the beginning inventory (600 x 30%) and units started during the period (7,800 x 100%). The correct answer is B.

Learning Objectives

- Determine equivalent units for conversion expenses.

Related questions

Super-Tech Industries Had the Following Department Information About Physical Units ...

Corsi Company Had the Following Department Data Materials Are Added ...

Cohen Company Is Trying to Determine the Equivalent Units for ...

Minor Company Had the Following Department Data Materials Are Added ...

A Process with No Beginning Work in Process Completed and ...