Asked by Leslie Katie on Jun 03, 2024

Verified

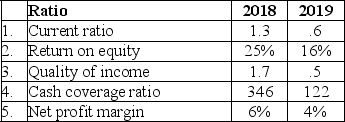

Carolina Company computed the following ratios for a two-year period:

A.Comment on the trend of each of the ratios from 2018 to 2019.State concerns or possible implications brought to light by each ratio.

A.Comment on the trend of each of the ratios from 2018 to 2019.State concerns or possible implications brought to light by each ratio.

B.State an overall opinion of the company's near future with suggestions for improvement.

Trend Analysis

The practice of collecting information and attempting to spot a pattern, often used in financial markets to predict future movements based on historical data.

Ratios Variation

Changes or differences in financial ratios over a period, potentially indicating shifts in a company's financial health or performance.

- Understand the implications of financial decisions and transactions on a company’s future and suggest improvements based on ratio analysis.

Verified Answer

JF

juliana fernandezJun 04, 2024

Final Answer :

Requirement A:

1.The current ratio has decreased to half of the 2018 ratio.Moreover,the ratio has declined to less than 1.0 and there is a strong possibility that currently due bills may not be able to be paid in a timely manner.

2.ROE decreased.The profitability of the company may be of concern.

3.The quality of income ratio decreased from 1.7 to below one (or 0.5).This indicates that the 2019 earnings are of lower quality than those of 2018.There may be net income on the income statement but cash flow may not be managed efficiently.

4.Cash coverage has plummeted.As noted in (3)above,there may be cash management inefficiencies.This ratio suggests that a continued decline might put interest payments in jeopardy.

5.Since the net profit margin declined from 2018 to 2019,less of each sales dollar is realized in net income.The decrease is not as drastic a change as other ratios above,so it is possible that attention to efficiently managing expenses might increase this ratio in a relatively short period of time.

Requirement B:

Overall,the company is experiencing unfavorable trends and is in dire need of attention to cash management for paying bills,getting and retaining quality customers,paying loan obligations,and streamlining expenses.There is a possibility of management fraud in the financial statements that are showing a profit but not liquidity,and perhaps fictitious sales are being recorded that do not have a possibility of cash collection.If the ratios cannot be improved in the near future,this company may have a problem staying in business.

1.The current ratio has decreased to half of the 2018 ratio.Moreover,the ratio has declined to less than 1.0 and there is a strong possibility that currently due bills may not be able to be paid in a timely manner.

2.ROE decreased.The profitability of the company may be of concern.

3.The quality of income ratio decreased from 1.7 to below one (or 0.5).This indicates that the 2019 earnings are of lower quality than those of 2018.There may be net income on the income statement but cash flow may not be managed efficiently.

4.Cash coverage has plummeted.As noted in (3)above,there may be cash management inefficiencies.This ratio suggests that a continued decline might put interest payments in jeopardy.

5.Since the net profit margin declined from 2018 to 2019,less of each sales dollar is realized in net income.The decrease is not as drastic a change as other ratios above,so it is possible that attention to efficiently managing expenses might increase this ratio in a relatively short period of time.

Requirement B:

Overall,the company is experiencing unfavorable trends and is in dire need of attention to cash management for paying bills,getting and retaining quality customers,paying loan obligations,and streamlining expenses.There is a possibility of management fraud in the financial statements that are showing a profit but not liquidity,and perhaps fictitious sales are being recorded that do not have a possibility of cash collection.If the ratios cannot be improved in the near future,this company may have a problem staying in business.

Learning Objectives

- Understand the implications of financial decisions and transactions on a company’s future and suggest improvements based on ratio analysis.

Related questions

Indicate the Effect of Each Item on the Particular Ratio ...

The Following Data Were Reported by Universe Company at Year-End ...

Compete Corporation Reported a Quick Ratio of 1 ...

Which of the Following Ratios Increases When Inventory Is Sold ...

Which of the Following Does Not Correctly Describe the Effect ...