Asked by Kathryn Lockwood on Jun 16, 2024

Verified

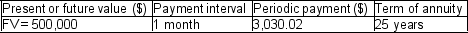

Calculate the nominal and effective rate of interest for the following ordinary annuity. Determine the nominal interest rate whose compounding interval equals the payment interval.

Nominal Rate

Refers to the interest rate before adjustments for inflation or other factors.

Effective Rate

The actual interest rate that borrowers pay or investors receive on a financial product, once all the compounding periods are factored in, often higher than the nominal rate.

Compounding Interval

The frequency at which interest is applied to the principal sum of a loan or deposit, affecting the total interest earned or paid.

- Distinguish between nominal and effective interest rates within various financial tools.

Verified Answer

Learning Objectives

- Distinguish between nominal and effective interest rates within various financial tools.

Related questions

If $100,000 Will Purchase a 20-Year Annuity Paying $830 at ...

What Quarterly Compounded Nominal Rate and Effective Rate of Interest ...

For $100,000, Royal Life Insurance Co ...

A $9,000, Four-Year Term Loan Requires Monthly Payments of $220 ...

Calculate the Nominal and Effective Rate of Interest for the ...