Asked by Nolan Blackwell on May 21, 2024

Verified

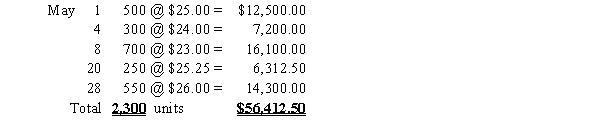

Brutus Corporation, a newly formed corporation, has the following transactions during May, its first month of operations.?? May 1 Purchased 500 units @$25.00@ \$ 25.00@$25.00 each.

4 Purchased 300 units @$24.00@ \$ 24.00@$24.00 each.

6 Sold 400 units @$38.00@ \$ 38.00@$38.00 each.

8 Purchased 700 units @$23.00@ \$ 23.00@$23.00 each.

13 Sold 450 units @$37.50@ \$ 37.50@$37.50 each.

20 Purchased 250 units @$25.25@ \$ 25.25@$25.25 each.

22 Sold 275 units @$36.00@ \$ 36.00@$36.00 each.

27 Sold 300 units @37.00@ 37.00@37.00 each.

28 Purchased 550 units @$26.00@ \$ 26.00@$26.00 each.

30 Sold 100 units @$39.00@ \$ 39.00@$39.00 each. Calculate total sales, cost of merchandise sold, gross profit, and ending inventory using each of the following inventory methods:

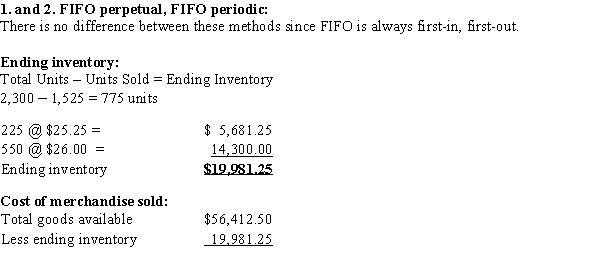

1. FIFO perpetual

2. FIFO periodic

3. LIFO perpetual

4. LIFO periodic

5. Average cost periodic

(round average to nearest cent)

FIFO Perpetual

An accounting method where the first items placed in inventory are the first ones sold, continuously tracking inventory levels.

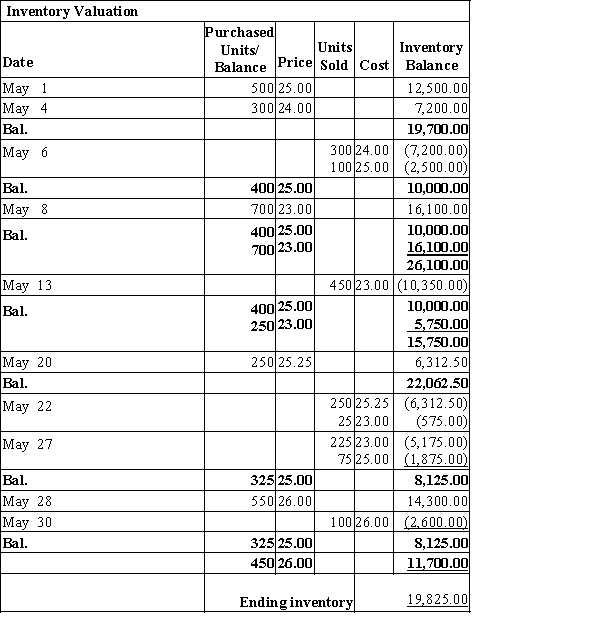

LIFO Perpetual

A method of inventory valuation where the last items acquired are the first to be used or sold, continuously updated to reflect remaining inventory.

Average Cost Periodic

A costing method where the cost of goods sold and ending inventory are valued at the average cost of all goods available for sale during the period.

- Ascertain gross profit and conclude ending inventory valuation employing differing assumptions on inventory cost flows.

- Evaluate the impact of cost flow assumptions on financial statements.

- Employ the perpetual inventory approach to compute the cost of sold merchandise and establish the ending inventory amount.

Verified Answer

(not dependent on inventory method):? May 6400@$38.00=$15,200.0013450@$37.50=16,875.0022275@$36.00=9,900.0027300@$37.00=11,100.0030100@$39.00=3,900.00 Total sales 1,525‾ units $50,075.00‾\begin{array}{l}\begin{array} { r r r r } \text { May } & 6 & 400 @ \$ 38.00 = & \$ 15,200.00 \\& 13 & 450 @ \$ 37.50 = & 16,875.00 \\& 22 & 275 @ \$ 36.00 = & 9,900.00 \\& 27 & 300 @ \$ 37.00 = & 11,100.00 \\& 30 & 100 @ \$ 39.00 = & 3,900.00\end{array}\\\text { Total sales } ~~~~\underline { \mathbf { 1 , 5 2 5 } } \text { units } ~~~~~~~~\underline { \mathbf { \$ 5 0 , 0 7 5 . 0 0 } }\end{array} May 613222730400@$38.00=450@$37.50=275@$36.00=300@$37.00=100@$39.00=$15,200.0016,875.009,900.0011,100.003,900.00 Total sales 1,525 units $50,075.00 Total merchandise available for sale:?

Cost of merchandise sold

Cost of merchandise sold  $36,431.25?Gross profit:? Total sales $56,975.00\quad \$ 56,975.00$56,975.00

$36,431.25?Gross profit:? Total sales $56,975.00\quad \$ 56,975.00$56,975.00 Less cost of merchandise

sold 36,431.25‾~~~~~~~~~~~~~~\underline{36,431.25} 36,431.25

Gross profit $ 20,543.75‾~~~~~~~~~\underline{\textbf{\$ 20,543.75}} $ 20,543.75

3. LIFO perpetual:Cost of merchandise sold:

? Total goods available $56,412.50\quad \$ 56,412.50$56,412.50

? Total goods available $56,412.50\quad \$ 56,412.50$56,412.50 Less ending inventory 19,825.00‾\quad \underline{19,825.00}19,825.00

Cost of merchandise sold $36,587.50‾\underline{\textbf{\$36,587.50}}$36,587.50 Gross profit:

4. LIFO periodic: Total sales $56,975.00 Less COMS 36,587.50‾ Gross profit $20,387.50‾\begin{array} { l l } \text { Total sales } & \$ 56,975.00 \\\text { Less COMS } & \underline{ 36,587.50 } \\\text { Gross profit } & \underline { \mathbf { \$ 2 0 , 3 8 7 .5 0 } }\end{array} Total sales Less COMS Gross profit $56,975.0036,587.50$20,387.50 ?Ending inventory:Cost of merchandise sold: 500@$25.00=$12,500.00275@$24.00=6,600.00‾ Ending inventory $19,100.00\begin{array}{lr}500 @ \$ 25.00= & \$ 12,500.00 \\275 @ \$ 24.00= & \underline{6 , 6 0 0 . 0 0} \\\text { Ending inventory } & \mathbf{\$ 19, 1 0 0 . 0 0}\end{array}500@$25.00=275@$24.00= Ending inventory $12,500.006,600.00$19,100.00 ? Total goods available $56,412.50 Less ending inventory 19,100.00‾ Cost of merchandise sold $37,312.50‾\begin{array} { l l } \text { Total goods available } & \$ 56,412.50 \\\text { Less ending inventory } & \underline { 19,100.00 } \\\text { Cost of merchandise sold }& \underline { \mathbf { \$ 3 7 , 3 1 2 . 5 0 } }\end{array} Total goods available Less ending inventory Cost of merchandise sold $56,412.5019,100.00$37,312.50 Gross profit:? Total sales $56,975.00 Less COMS 37,312.50‾Gross profit$19,662.50‾\begin{array} { l r } \text { Total sales } & \$ 56,975.00 \\\text { Less COMS } & \underline{ 37,312.50 }\\\text{Gross profit}&\underline{ \mathbf { \$ 1 9 , 6 6 2 . 5 0 } }\end{array} Total sales Less COMS Gross profit$56,975.0037,312.50$19,662.50

5. Average cost periodic:?Average cost: $56,412.50/2,300 units = $24.53Ending inventory:775 units × $24.53 = $19,010.75Cost of merchandise sold:$56,412.50 - $19,010.75 = $37,401.75Gross profit:$56,975.00 - $37,401.75 = $19,573.25?

Learning Objectives

- Ascertain gross profit and conclude ending inventory valuation employing differing assumptions on inventory cost flows.

- Evaluate the impact of cost flow assumptions on financial statements.

- Employ the perpetual inventory approach to compute the cost of sold merchandise and establish the ending inventory amount.

Related questions

Nicki's Pet Supply Needs to Estimate Its Ending Inventory ...

The Units of Manganese Plus Available for Sale During the ...

Beginning Inventory, Purchases, and Sales Data for Tennis Rackets Are ...

Assume That Three Identical Units of Merchandise Were Purchased During ...

The Units of Manganese Plus Available for Sale During the ...