Asked by Larissa Lopez on May 01, 2024

Verified

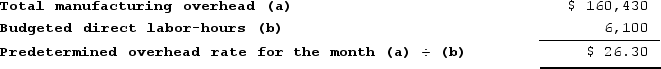

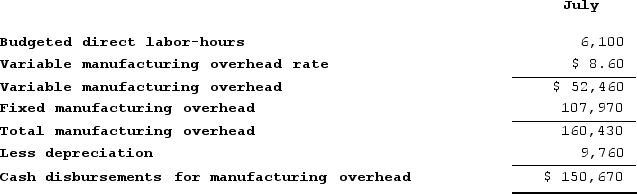

Brockney Incorporated bases its manufacturing overhead budget on budgeted direct labor-hours. The variable overhead rate is $8.60 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $107,970 per month, which includes depreciation of $9,760. All other fixed manufacturing overhead costs represent current cash flows. The July direct labor budget indicates that 6,100 direct labor-hours will be required in that month.Required:a. Determine the cash disbursements for manufacturing overhead for July.b. Determine the predetermined overhead rate for July.

Variable Overhead Rate

The cost per unit of varying overhead expenses that change with the level of production activity.

Fixed Manufacturing Overhead

The portion of manufacturing overhead costs that do not vary with the level of production.

Predetermined Overhead Rate

This rate is used to allocate manufacturing overhead to individual units produced, based on a predetermined formula.

- Evaluate direct labor demands and their corresponding costs tailored to production goals.

- Analyze the effects of depreciation and other non-cash expenses on budgeting.

Verified Answer

Learning Objectives

- Evaluate direct labor demands and their corresponding costs tailored to production goals.

- Analyze the effects of depreciation and other non-cash expenses on budgeting.

Related questions

Whitmer Corporation Is Working on Its Direct Labor Budget for ...

Sthilaire Corporation Is Working on Its Direct Labor Budget for ...

Sthilaire Corporation Is Working on Its Direct Labor Budget for ...

The Selling and Administrative Expense Budget of Garney Corporation Is ...

Wala Incorporated Bases Its Selling and Administrative Expense Budget on ...

b.

b.