Asked by tehseen malik on May 20, 2024

Verified

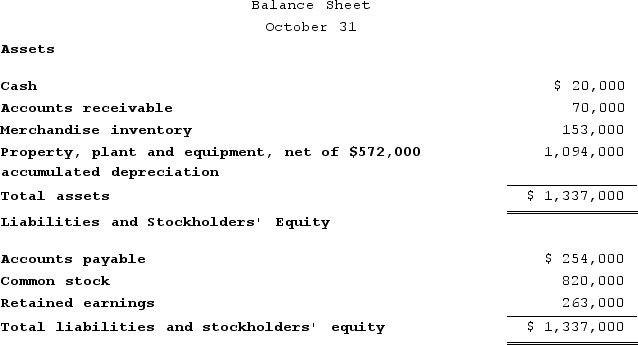

Bramble Corporation is a small wholesaler of gourmet food products. Data regarding the store's operations follow:Sales are budgeted at $340,000 for November, $320,000 for December, and $310,000 for January.Collections are expected to be 80% in the month of sale and 20% in the month following the sale.The cost of goods sold is 75% of sales.The company would like to maintain ending merchandise inventories equal to 60% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase.Other monthly expenses to be paid in cash are $24,000.Monthly depreciation is $15,000.Ignore taxes.  Expected cash collections in December are:

Expected cash collections in December are:

A) $68,000

B) $256,000

C) $320,000

D) $324,000

Cash Collections

The process or total amount of cash received from customers for goods or services.

Cost of Goods Sold

This refers to the direct costs attributable to goods produced and sold by a business, including materials, labor, and overhead expenses.

Merchandise Inventories

Goods and products that a company holds for the purpose of resale to customers.

- Ascertain the sum of cash collected from sales executed on credit.

Verified Answer

Therefore, the answer is D) $324,000.

Learning Objectives

- Ascertain the sum of cash collected from sales executed on credit.

Related questions

Michard Corporation Makes One Product and It Provided the Following ...

Cash Collections in a Schedule of Cash Collections Typically Consist ...

Sioux Corporation Is Estimating the Following Sales for the First ...

Groundworks Company Budgeted the Following Credit Sales During the Current ...

Ewing Company Budgeted Sales for January,February,and March of $96,000,$88,000,and $72,000,respectively ...