Asked by Madeline Lombardo on Jul 13, 2024

Verified

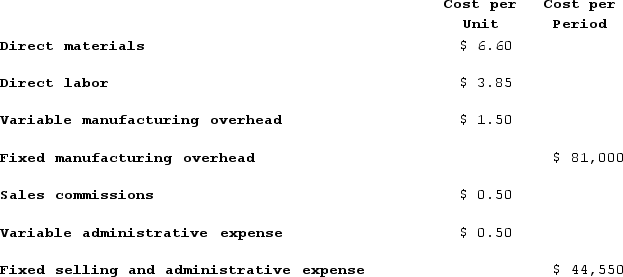

Bowering Corporation has provided the following information:  For financial reporting purposes, the total amount of period costs incurred to sell 9,000 units is closest to:

For financial reporting purposes, the total amount of period costs incurred to sell 9,000 units is closest to:

A) $35,700

B) $9,000

C) $53,550

D) $44,550

Period Costs

Costs that are not directly tied to production and are expensed in the period in which they are incurred, such as selling, general, and administrative expenses.

Financial Reporting

The process of producing statements that disclose an organization's financial status to management, investors, and the government, including balance sheets, income statements, and cash flow statements.

Units

Basic quantities or measurements, often expressed as part of a system of counting or measuring that is used to quantify material or immaterial objects.

- Assess the impact of different cost structures on financial reporting for a business.

Verified Answer

To calculate the total period costs, we need to add up all the expenses that are related to selling the product. However, we don't have a list of expenses, only a total cost. Therefore, we can use the contribution margin per unit to estimate the period costs.

The contribution margin per unit is calculated as the selling price per unit minus the variable cost per unit. In this case, we don't have any information about the selling price or the variable cost per unit, so we are unable to calculate the contribution margin. However, we know that the total revenue from selling 9,000 units is:

Total Revenue = Units Sold x Selling Price per Unit = 9,000 x Selling Price per Unit

Since we don't know the selling price per unit, we cannot calculate the total revenue. However, we know that the contribution margin ratio is equal to the contribution margin per unit divided by the selling price per unit. Therefore:

Contribution Margin Ratio = Contribution Margin per Unit / Selling Price per Unit

We can rearrange this equation to solve for the contribution margin per unit:

Contribution Margin per Unit = Contribution Margin Ratio x Selling Price per Unit

Again, we don't have the selling price per unit, but we can assume that the contribution margin ratio is 30%. This means that for every dollar of revenue generated, 30 cents are available to cover fixed costs and profit. Therefore:

Contribution Margin per Unit = 30% x Selling Price per Unit

Multiplying both sides by 10/3, we get:

Contribution Margin per Unit = 100 / 3 x (10% x Selling Price per Unit)

Now, we need to estimate the period costs based on this contribution margin per unit. Assuming that the only costs associated with selling the product are period costs, we can calculate the total period costs as:

Total Period Costs = Units Sold x Contribution Margin per Unit

Total Period Costs = 9,000 x (100 / 3 x 10% x Selling Price per Unit)

Total Period Costs = 30 x 9,000 x Selling Price per Unit / 100

Total Period Costs = 2,700 x Selling Price per Unit

Since we don't have the selling price per unit, we cannot calculate the total period costs exactly. However, we can use the given answer choices to estimate the selling price per unit, as follows:

A) $35,700 / 9,000 units = $3.97 per unit

B) $9,000 / 9,000 units = $1.00 per unit

C) $53,550 / 9,000 units = $5.95 per unit

D) $44,550 / 9,000 units = $4.95 per unit

Out of these choices, option C gives us the closest estimate of the selling price per unit. Therefore, the best choice for the total amount of period costs is option C:

Total Period Costs = 2,700 x $5.95 = $16,065

Note that this is an estimate, and the actual period costs may differ depending on the specific expenses incurred by Bowering Corporation.

Learning Objectives

- Assess the impact of different cost structures on financial reporting for a business.

Related questions

The Costing Approach That Meets the Requirements of Financial Accounting ...

For Financial Reporting Purposes, the Total Amount of Product Costs ...

Which of the Following Would Be Reported on a Variable ...

Given Advanced Company's Data,and the Knowledge That the Product Is ...

A Partial Listing of Costs Incurred During March at Febbo ...