Asked by Trevor Demuth on Jul 14, 2024

Verified

Bonzo Co.owns a building in Pennsylvania.The historical cost of the building is $1,050,000 and $540,000 of accumulated depreciation has been recorded to date.During 2015,Bonzo incurred the following expenses related to the building:

Repaired a broken water main $81,500 Major improvement to the HVAC system 75,000 Added a 6,000 square foot employees’ lounge 197,500 Replaced the carpet in the purchasing department offices 21,300 Repainted the building 25,000\begin{array}{lr}\text { Repaired a broken water main } & \$ 81,500 \\\text { Major improvement to the HVAC system } & 75,000 \\\text { Added a 6,000 square foot employees' lounge } & 197,500 \\\text { Replaced the carpet in the purchasing department offices } & 21,300 \\\text { Repainted the building } & 25,000\end{array} Repaired a broken water main Major improvement to the HVAC system Added a 6,000 square foot employees’ lounge Replaced the carpet in the purchasing department offices Repainted the building $81,50075,000197,50021,30025,000

Required:

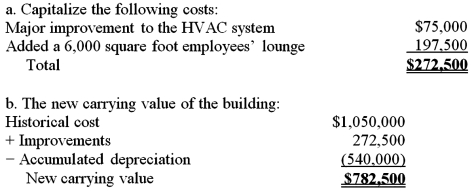

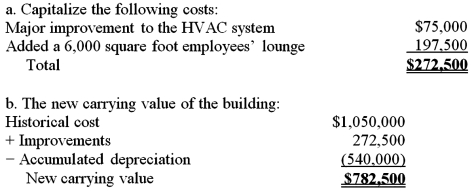

a.Which of the building related costs incurred by Bonzo Co.should be capitalized in 2015?

b.What is the subsequent carrying amount of the building?

Accumulated Depreciation

The complete portion of a physical asset's initial cost that has been charged off as depreciation expense from the time the asset became operational.

Historical Cost

The original monetary value of an asset as it appears in the financial records, not adjusted for inflation or changes in value.

Subsequent Carrying

The process of recording or managing an asset on the balance sheet after its initial recognition, reflecting any changes in value.

- Determine which costs should be capitalized in relation to property, plant, and equipment expenditures.

Verified Answer

JC

Jazzlyn ChaidezJul 21, 2024

Final Answer :  Feedback:GAAP requires a company to capitalize expenditures that extend an asset's useful life,increase its capacity or efficiency,or cause any other increase in its economic benefits.A major improvement to the HVAC system and a building addition meet these criteria and are capitalized costs.The painting,carpet,and repair costs are expensed since they do not improve efficiency or extend the productive life of the building.

Feedback:GAAP requires a company to capitalize expenditures that extend an asset's useful life,increase its capacity or efficiency,or cause any other increase in its economic benefits.A major improvement to the HVAC system and a building addition meet these criteria and are capitalized costs.The painting,carpet,and repair costs are expensed since they do not improve efficiency or extend the productive life of the building.

Feedback:GAAP requires a company to capitalize expenditures that extend an asset's useful life,increase its capacity or efficiency,or cause any other increase in its economic benefits.A major improvement to the HVAC system and a building addition meet these criteria and are capitalized costs.The painting,carpet,and repair costs are expensed since they do not improve efficiency or extend the productive life of the building.

Feedback:GAAP requires a company to capitalize expenditures that extend an asset's useful life,increase its capacity or efficiency,or cause any other increase in its economic benefits.A major improvement to the HVAC system and a building addition meet these criteria and are capitalized costs.The painting,carpet,and repair costs are expensed since they do not improve efficiency or extend the productive life of the building.

Learning Objectives

- Determine which costs should be capitalized in relation to property, plant, and equipment expenditures.