Asked by Vanessa Huynh on Jun 12, 2024

Verified

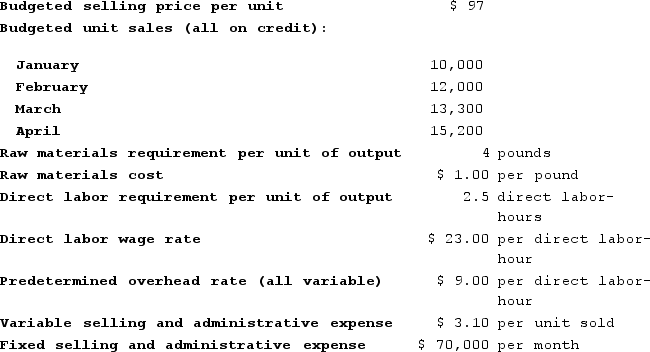

Bonkowski Corporation makes one product and has provided the following information to help prepare the master budget for the next four months of operations:  Credit sales are collected:30% in the month of the sale70% in the following monthRaw materials purchases are paid:30% in the month of purchase70% in the following monthThe ending finished goods inventory should equal 30% of the following month's sales. The ending raw materials inventory should equal 10% of the following month's raw materials production needs.The estimated unit product cost is closest to:

Credit sales are collected:30% in the month of the sale70% in the following monthRaw materials purchases are paid:30% in the month of purchase70% in the following monthThe ending finished goods inventory should equal 30% of the following month's sales. The ending raw materials inventory should equal 10% of the following month's raw materials production needs.The estimated unit product cost is closest to:

A) $70.50

B) $22.50

C) $84.00

D) $61.50

Unit Product Cost

The total cost to produce one unit of product, including direct materials, direct labor, and overhead.

Master Budget

A comprehensive financial plan that combines all of an organization's individual budgets (sales, production, overhead, etc.) into one master document.

Credit Sales

Sales transactions where the customer is allowed to purchase goods or services with an agreement to pay at a later date.

- Appraise budgeted financial anticipations, like the cost of goods sold, direct labor investments, and purchase needs.

- Analyze budgeting reports to understand business achievements and formulate operational plans.

Verified Answer

1. Sales:

Month 1 sales = $100,000

Month 2 sales = $120,000

Month 3 sales = $140,000

Month 4 sales = $160,000

2. Raw materials:

Month 1 raw materials needs = $60,000

Month 2 raw materials needs = $70,000

Month 3 raw materials needs = $80,000

Month 4 raw materials needs = $90,000

3. Production:

Month 1 production = Month 1 sales = 1,000 units

Month 2 production = Month 2 sales + 30% of Month 1 sales - ending finished goods inventory = 1,260 units

Month 3 production = Month 3 sales + 30% of Month 2 sales - ending finished goods inventory = 1,512 units

Month 4 production = Month 4 sales + 30% of Month 3 sales - ending finished goods inventory = 1,816 units

4. Raw materials purchases:

Month 1 raw materials purchases = $60,000

Month 2 raw materials purchases = Month 2 raw materials needs + 10% of Month 1 raw materials needs - ending raw materials inventory = $70,000

Month 3 raw materials purchases = Month 3 raw materials needs + 10% of Month 2 raw materials needs - ending raw materials inventory = $80,500

Month 4 raw materials purchases = Month 4 raw materials needs + 10% of Month 3 raw materials needs - ending raw materials inventory = $92,050

5. Credit sales collection:

Month 1 collection = 30% of Month 1 sales = $30,000

Month 2 collection = 70% of Month 1 sales + 30% of Month 2 sales = $84,000

Month 3 collection = 70% of Month 2 sales + 30% of Month 3 sales = $119,000

Month 4 collection = 70% of Month 3 sales + 30% of Month 4 sales = $154,000

Unit product cost = (Month 1 production cost + Month 2 production cost + Month 3 production cost + Month 4 production cost) ÷ Total units produced

Month 1 production cost = Month 1 raw materials purchases × 30% + ($20 × 1,000 units)

Month 2 production cost = Month 2 raw materials purchases × 30% + ($20 × 1,260 units)

Month 3 production cost = Month 3 raw materials purchases × 30% + ($20 × 1,512 units)

Month 4 production cost = Month 4 raw materials purchases × 30% + ($20 × 1,816 units)

Unit product cost = (($18,000 + $21,000 + $24,150 + $27,616) ÷ 5,588 units) ≈ $84.00.

Therefore, the estimated unit product cost is closest to $84.00, which is answer C.

Learning Objectives

- Appraise budgeted financial anticipations, like the cost of goods sold, direct labor investments, and purchase needs.

- Analyze budgeting reports to understand business achievements and formulate operational plans.

Related questions

Smith Corporation Makes and Sells a Single Product Called a ...

Sarafiny Corporation Is in the Process of Preparing Its Annual ...

Sarafiny Corporation Is in the Process of Preparing Its Annual ...

The LFH Corporation Makes and Sells a Single Product, Product ...

Smith Corporation Makes and Sells a Single Product Called a ...