Asked by estefani Ramirez on Apr 25, 2024

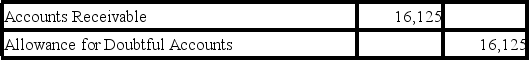

At the end of the current year,using the aging of receivable method,management estimated that $15,750 of the accounts receivable balance would be uncollectible.Prior to any year-end adjustments,the Allowance for Doubtful Accounts had a debit balance of $375.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

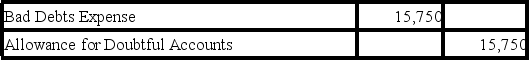

A)

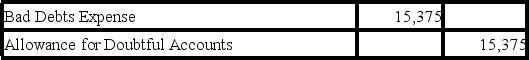

B)

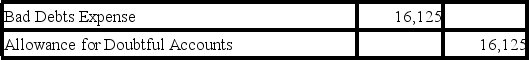

C)

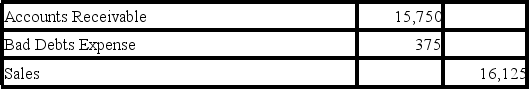

D)

E)

Aging of Receivable Method

An accounting technique used to estimate bad debts by analyzing accounts receivable based on the length of time they have been outstanding.

Allowance for Doubtful Accounts

A contra-asset account that represents the amount of receivables a company does not expect to actually collect.

Bad Debts Expense

An expense account reflecting the cost of accounts receivable that a company does not expect to collect due to customer defaults.

- Invoke the percent of revenue approach for the appraisal of bad debts expense.

Learning Objectives

- Invoke the percent of revenue approach for the appraisal of bad debts expense.

Related questions

A Company Uses the Percent of Sales Method to Determine ...

A Company Uses the Percent of Sales Method to Determine ...

On December 31 of the Current Year,the Unadjusted Trial Balance ...

A Company Has $90,000 in Outstanding Accounts Receivable and It ...

The Allowance Method That Assumes a Given Percent of a ...