Asked by Erika Driesen on Jun 18, 2024

Verified

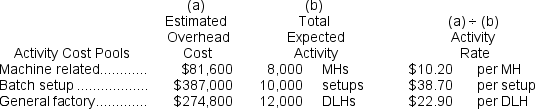

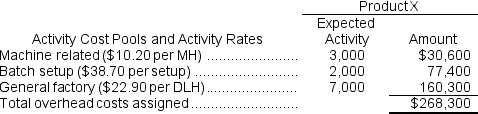

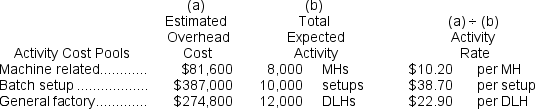

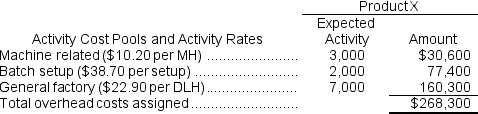

Assuming that actual activity turns out to be the same as expected activity, the total amount of overhead cost allocated to Product X would be closest to:

A) $371,700

B) $387,000

C) $268,300

D) $149,000

Overhead Cost Allocated

Expenses related to the running of a business that are spread out across different departments or products.

- Evaluate the allocation of overhead expenses to products according to conventional costing principles.

Verified Answer

LL

lissette lopezJun 23, 2024

Final Answer :

C

Explanation :

Reference: CH04-Ref14

Reference: CH04-Ref14

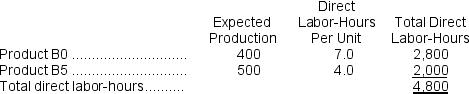

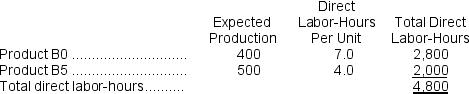

Barkes, Inc., manufactures and sells two products: Product B0 and Product B5.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below: The direct labor rate is $22.10 per DLH.The direct materials cost per unit is $288.10 for Product B0 and $118.90 for Product B5.

The direct labor rate is $22.10 per DLH.The direct materials cost per unit is $288.10 for Product B0 and $118.90 for Product B5.

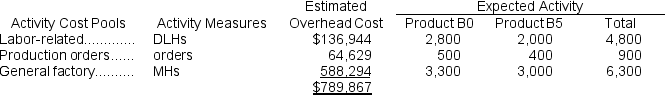

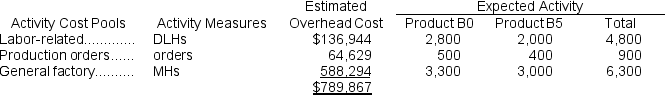

The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

Reference: CH04-Ref14

Reference: CH04-Ref14Barkes, Inc., manufactures and sells two products: Product B0 and Product B5.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:

The direct labor rate is $22.10 per DLH.The direct materials cost per unit is $288.10 for Product B0 and $118.90 for Product B5.

The direct labor rate is $22.10 per DLH.The direct materials cost per unit is $288.10 for Product B0 and $118.90 for Product B5.The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

Learning Objectives

- Evaluate the allocation of overhead expenses to products according to conventional costing principles.