Asked by Lyric Bolden on May 20, 2024

Verified

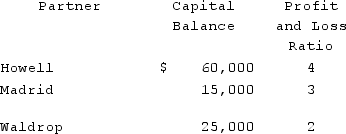

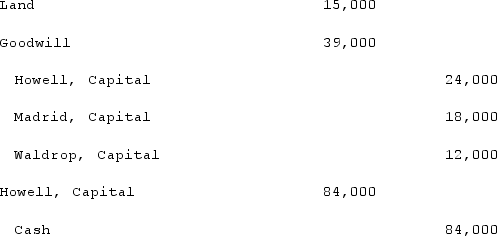

Assume the partnership of Howell, Madrid, and Waldrop has been in existence for a number of years.Howell decides to withdraw from the partnership when the partners' capital balances are as follows:  An appraisal of the business and its net assets estimates the fair value to be $154,000. Land with a book value of $20,000 has a fair value of $35,000.Howell has agreed to receive $84,000 in exchange for her partnership interest.Prepare the journal entries for the dissolution of Howell's partnership interest, assuming the goodwill method is to be applied.

An appraisal of the business and its net assets estimates the fair value to be $154,000. Land with a book value of $20,000 has a fair value of $35,000.Howell has agreed to receive $84,000 in exchange for her partnership interest.Prepare the journal entries for the dissolution of Howell's partnership interest, assuming the goodwill method is to be applied.

Goodwill Method

An accounting method used to evaluate the excess of purchase price over the fair value of net identifiable assets acquired in a business combination.

Journal Entries

Recorded transactions in the accounting records of a business that are used to transfer amounts from one account to another, ensuring the ledger remains in balance.

Fair Value

Fair value is an estimate of the market value of an asset, based on its current price in a fair and open market transaction.

- Compute the revised capital accounts after a new partner joins or an existing partner departs.

Verified Answer

Learning Objectives

- Compute the revised capital accounts after a new partner joins or an existing partner departs.

Related questions

On November 30 Capital Balances Are Ross $300000 Ellis $250000 ...

Thao and Leslie Are Partners Who Share Profits 60% and ...

Dawn Garret and Josh Have Partnership Capital Account Balances of ...

Benson and Orton Are Partners Who Share Income in the ...

Benton and Orton Are Partners Who Share Income in the ...