Asked by Crystal Weaver on Jun 18, 2024

Verified

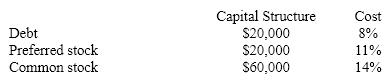

Assume the following information about a firm's capital components:  The firm's WACC is:

The firm's WACC is:

A) 11.00%.

B) 11.90%.

C) 12.20%.

D) 12.05%.

WACC

Weighted Average Cost of Capital, the average rate of return a company is expected to pay its security holders to finance its assets.

Capital Components

The various sources of capital for a firm, including debt and equity, each with different costs and risks, influencing the company's WACC.

Firm's Capital

The financial resources a company uses for its operations, including equity, debt, and retained earnings.

- Determine the specific costs of capital components by utilizing provided financial data.

Verified Answer

FH

Francis HovanecJun 19, 2024

Final Answer :

C

Explanation :

The WACC is calculated as follows:

WACC = (E/V x Re) + ((D/V x Rd) x (1 - Tc))

where

E = market value of the firm's equity

D = market value of the firm's debt

V = E + D

Re = cost of equity

Rd = cost of debt

Tc = corporate tax rate

Given information:

Total market value of capital = $130,000 + $70,000 = $200,000

Equity = $130,000

Debt = $70,000

Cost of equity (Re) = 16%

Cost of debt (Rd) = 8%

Tax rate (Tc) = 40%

WACC = (130,000/200,000 x 16%) + ((70,000/200,000 x 8%) x (1 - 40%))

WACC = 0.832 x 0.048 x 0.6

WACC = 0.02392 or 2.39%

Therefore, the firm's WACC is 12.20% (rounded to 2 decimal places).

WACC = (E/V x Re) + ((D/V x Rd) x (1 - Tc))

where

E = market value of the firm's equity

D = market value of the firm's debt

V = E + D

Re = cost of equity

Rd = cost of debt

Tc = corporate tax rate

Given information:

Total market value of capital = $130,000 + $70,000 = $200,000

Equity = $130,000

Debt = $70,000

Cost of equity (Re) = 16%

Cost of debt (Rd) = 8%

Tax rate (Tc) = 40%

WACC = (130,000/200,000 x 16%) + ((70,000/200,000 x 8%) x (1 - 40%))

WACC = 0.832 x 0.048 x 0.6

WACC = 0.02392 or 2.39%

Therefore, the firm's WACC is 12.20% (rounded to 2 decimal places).

Learning Objectives

- Determine the specific costs of capital components by utilizing provided financial data.