Asked by Blake cannistraro on Jul 03, 2024

Verified

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 40% on manufacturing cost to establish selling prices.The calculated selling price for Job A is closest to:

A) $51,970

B) $72,758

C) $80,034

D) $20,788

Predetermined Manufacturing Overhead

The estimated cost of manufacturing overhead assigned to each unit of production, based on a predetermined rate.

Machine-hours

A measure of the amount of time a machine is used for production, often used in allocating manufacturing overhead based on usage.

Markup

The amount added to the cost price of goods, to cover overhead and profit, determining the selling price.

- Comprehend the technique of utilizing a plantwide predetermined manufacturing overhead rate.

- Ascertain the total expenses in manufacturing apportioned to specific tasks.

- Gain proficiency in determining the selling price of jobs based on manufacturing cost and markup.

Verified Answer

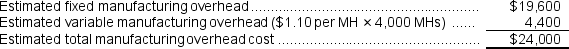

Molding

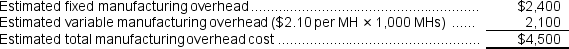

Finishing

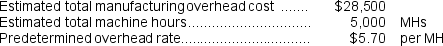

Finishing  The second step is to combine the estimated manufacturing overhead costs in the two departments ($24,000 + $4,500 = $28,500)to calculate the plantwide predetermined overhead rate as follow:

The second step is to combine the estimated manufacturing overhead costs in the two departments ($24,000 + $4,500 = $28,500)to calculate the plantwide predetermined overhead rate as follow:  The overhead applied to Job A is calculated as follows:

The overhead applied to Job A is calculated as follows:Overhead applied to a particular job = Predetermined overhead rate x Machine-hours incurred by the job

= $5.70 per MH x (2,700 MHs + 400 MHs)

= $5.70 per MH x (3,100 MHs)

= $17,670

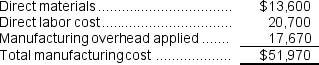

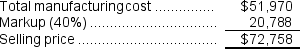

Job A's manufacturing cost:

The selling price for Job A:

The selling price for Job A:  Reference: CH02-Ref12

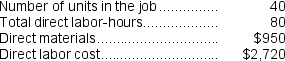

Reference: CH02-Ref12Lueckenhoff Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours.The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $497,000, variable manufacturing overhead of $2.40 per direct labor-hour, and 70,000 direct labor-hours.The company has provided the following data concerning Job T498 which was recently completed:

Learning Objectives

- Comprehend the technique of utilizing a plantwide predetermined manufacturing overhead rate.

- Ascertain the total expenses in manufacturing apportioned to specific tasks.

- Gain proficiency in determining the selling price of jobs based on manufacturing cost and markup.

Related questions

Assume That the Company Uses a Plantwide Predetermined Manufacturing Overhead ...

Assume That the Company Uses a Plantwide Predetermined Manufacturing Overhead ...

Dietzen Corporation Has Two Manufacturing Departments--Casting and Finishing ...

Levron Corporation Uses a Job-Order Costing System with a Single ...

The Ending Work in Process Inventory Is Subtracted from the ...