Asked by Dinesh Sivanesan on May 04, 2024

Verified

ART has come out with a new and improved product. As a result, the firm projects an ROE of 25%, and it will maintain a plowback ratio of 0.20. Its earnings this year will be $3 per share. Investors expect a 12% rate of return on the stock.

What is the present value of growth opportunities for ART?

A) $8.57

B) $9.29

C) $14.29

D) $16.29

ROE

Return on Equity, a measure of a corporation's profitability by revealing how much profit a company generates with the money shareholders have invested.

Plowback Ratio

A measure indicating the proportion of earnings retained by a company for reinvestment, rather than being paid out as dividends.

Present Value

The current value of a future sum of money or stream of cash flows given a specified rate of return, often used in the time value of money calculations.

- Learn about the Present Value of Growth Opportunities (PVGO) and its effect on the assessment of a firm's value.

- Assess the impact of earnings growth, reinvestment rates, and required returns on stock price and valuation.

Verified Answer

KS

Keleque SmithMay 11, 2024

Final Answer :

B

Explanation :

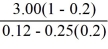

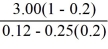

P0 =  = 34.29

= 34.29

PVGO = P0 - (EPS1/k) = 34.29 - (3/.12) = $9.29

= 34.29

= 34.29PVGO = P0 - (EPS1/k) = 34.29 - (3/.12) = $9.29

Learning Objectives

- Learn about the Present Value of Growth Opportunities (PVGO) and its effect on the assessment of a firm's value.

- Assess the impact of earnings growth, reinvestment rates, and required returns on stock price and valuation.