Asked by Brycen Cluster on Jun 01, 2024

Verified

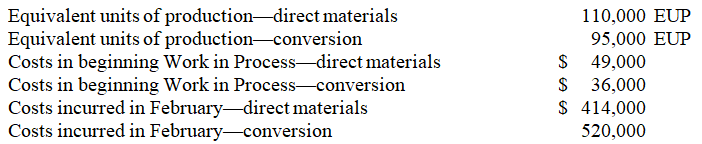

Andrews Corporation uses the weighted-average method of process costing.The following information is available for February in its Polishing Department:  The cost per equivalent unit of production for conversion is:

The cost per equivalent unit of production for conversion is:

A) $9.26

B) $4.21

C) $5.85

D) $5.05

E) $4.97

Equivalent Unit

A measure used in cost accounting to express the amount of work done on units of production during a period, considering partially completed units.

Conversion Costs

The cost required to convert raw materials into finished products, typically including labor and overhead expenses.

- Determine and explain the price per equivalent unit.

Verified Answer

TJ

Taylor JabczenskiJun 02, 2024

Final Answer :

C

Explanation :

To calculate the cost per equivalent unit of production for conversion, we need to add the total conversion costs for the period (i.e. $146,282) to the equivalent units of production for conversion (i.e. 25,010) to get the total cost to be accounted for (i.e. $606,282).

Then we divide the total cost to be accounted for by the equivalent units of production for conversion to get the cost per equivalent unit of production for conversion.

($606,282/25,010 = $24.24)

Therefore, the cost per equivalent unit of production for conversion is $5.85.

Then we divide the total cost to be accounted for by the equivalent units of production for conversion to get the cost per equivalent unit of production for conversion.

($606,282/25,010 = $24.24)

Therefore, the cost per equivalent unit of production for conversion is $5.85.

Learning Objectives

- Determine and explain the price per equivalent unit.

Related questions

During March,the Production Department of a Process Operations System Completed ...

Hache Corporation Uses the Weighted-Average Method in Its Process Costing ...

Raider Corporation Uses the Weighted-Average Method in Its Process Costing ...

Hache Corporation Uses the Weighted-Average Method in Its Process Costing ...

Assuming That All Direct Materials Are Placed in Process at ...