Asked by Chhor Sotheanea on Jun 07, 2024

Verified

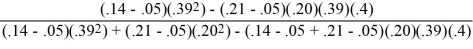

An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 21% and a standard deviation of return of 39%. Stock B has an expected return of 14% and a standard deviation of return of 20%. The correlation coefficient between the returns of A and B is .4. The risk-free rate of return is 5%. The proportion of the optimal risky portfolio that should be invested in stock B is approximately ________.

A) 29%

B) 44%

C) 56%

D) 71%

Optimal Risky Portfolio

An optimal risky portfolio is a collection of financial assets that maximizes expected return for a given level of risk or minimizes risk for a given level of expected return.

Correlation Coefficient

A statistical measure that calculates the strength and direction of a linear relationship between two variables on a scatter plot.

- Acquire insight into the concepts of risk and expected return as they pertain to portfolio theory.

- Comprehend the significance of risk aversion in the selection of portfolios and allocation of assets.

- Become acquainted with critical concepts in portfolio management like the efficient frontier, capital market line, and optimal risky portfolio.

Verified Answer

JM

Learning Objectives

- Acquire insight into the concepts of risk and expected return as they pertain to portfolio theory.

- Comprehend the significance of risk aversion in the selection of portfolios and allocation of assets.

- Become acquainted with critical concepts in portfolio management like the efficient frontier, capital market line, and optimal risky portfolio.

WB = 71%

WB = 71%