Asked by Julia Guerrero on Jul 06, 2024

Verified

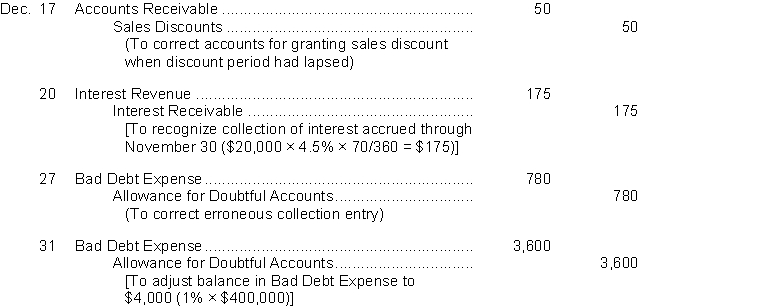

An inexperienced accountant made the following entries. In each case the explanation to the entry is correct. 27Cash780Bad Debt Expense 780 (Collection of account previously written off as uncollectible under allowance method) \begin{array}{lrr} \text { 27\quad\quad Cash} &780\\\quad\quad\quad \text {Bad Debt Expense } &&780\\ \quad\quad\text { (Collection of account previously written off as } &\\ \quad\quad\text { uncollectible under allowance method) } &\\\end{array} 27CashBad Debt Expense (Collection of account previously written off as uncollectible under allowance method) 780780

31Bad Debt Expense400 Allowance for Doubtful Accounts400 (To recognize estimated bad debts based on 1% of net sales of $400,000 \begin{array}{lll} \text { 31\quad\quad Bad Debt Expense} &400\\\quad\quad\quad \text { Allowance for Doubtful Accounts} &&400\\\quad\quad\text { (To recognize estimated bad debts based on \( 1 \% \) } &\\ \quad\quad\text { of net sales of \( \$ 400,000 \) } &\\\end{array} 31Bad Debt Expense Allowance for Doubtful Accounts (To recognize estimated bad debts based on 1% of net sales of $400,000 400400

Instructions

Prepare the correcting entries.

Allowance for Doubtful Accounts

A contra-asset account that reduces the total accounts receivable balance to reflect accounts that are expected not to be collected.

Bad Debt Expense

An expense recognized when receivables are no longer collectible due to customer default.

- Recognize and correct erroneous accounting entries related to receivables and bad debts.

Verified Answer

KM

Learning Objectives

- Recognize and correct erroneous accounting entries related to receivables and bad debts.