Asked by Jessica Shatteen on Jul 21, 2024

Verified

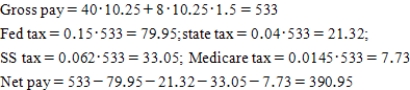

Adam works at an electronics store,earning $10.25 an hour,and is paid time and a half for any overtime.Last week,he worked 48 hours.His federal tax withheld is 15% and his state tax withheld is 4%.Social Security and Medicare taxes are also withheld.Determine his net pay for the week.

Time And A Half

Time and a half refers to the pay rate that is 1.5 times higher than the normal rate, usually applied to hours worked beyond the standard workweek.

Net Pay

The amount of money that an employee receives after deductions such as taxes and social security contributions have been subtracted from their gross salary.

Overtime

Additional hours worked beyond the standard or agreed working hours, typically compensated at a higher pay rate.

- Acquire knowledge on how withholdings and deductions are calculated and their significance in an employee's pay.

Verified Answer

Learning Objectives

- Acquire knowledge on how withholdings and deductions are calculated and their significance in an employee's pay.

Related questions

Nancy Was Laid Off and Applied for Unemployment Benefits in ...

Marcus Earned $54,000 Last Year When the Social Security Tax ...

The Amount of Federal Income Taxes Withheld Should Approximate the ...

Explain the Responsibilities of and the Accounting by Employers for ...

Each Year, There Is a Ceiling for the Amount That ...