Asked by Jocelyn Bello-Paez on Jul 26, 2024

Verified

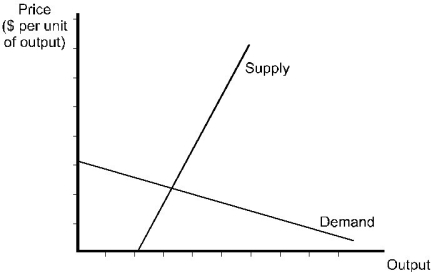

A specific tax will be imposed on a good. The supply and demand curves for the good are shown in the diagram below. Given this information, the burden of the tax:

A) is shared about evenly between consumers and producers.

B) falls mostly on consumers.

C) falls mostly on producers.

D) cannot be determined without more information on the price elasticities of supply and demand.

Price Elasticities

Measures of how sensitive the demand or supply of a product is to changes in its price.

Tax Burden

The total amount of taxes paid by individuals or businesses, expressed as a percentage of income or as an absolute amount.

Supply and Demand

A fundamental economic model that describes how prices and quantities are determined in a market based on producers' supply and consumers' demand.

- Examine the allocation of tax responsibilities among consumers and producers.

- Determine the impact of supply and demand elasticities on the distribution of tax burdens.

Verified Answer

Learning Objectives

- Examine the allocation of tax responsibilities among consumers and producers.

- Determine the impact of supply and demand elasticities on the distribution of tax burdens.

Related questions

A Few Years Ago, the City of Seattle, Washington, Considered ...

When the Government Imposes a Specific Tax Per Unit on ...

The Demand Curve, Which Is a Downward-Sloping Straight Line, Crosses ...

The Inverse Demand Function for Video Games Is P <Font ...

The Demand Curve for Rutabagas Is a Straight Line with ...